Ecosphere Technologies Inc: A Diversified Water Engineering Company With Significant Long-Term Upside Potential

Introduction:

I am always on the hunt for a solid long-term play in the water sector. In such a fragmented market, it is hard to come by a pure play water company that has its hands in each piece of the water market. Instead of trying to find the next Xylem (XYL), I have turned my attention to a smaller player that deals with this investment theme. Through targeting of an individual section of a very specialized market, it is my opinion that returns can be larger than simply throwing money into a broad based play. The water market is made up a large number of companies such as Northwest Pipe (NWPX) all the way to utilities like American Water Works (AWK) and the foreign plays such as Sabesp (SBS).

Ecosphere Technologies Inc., (OTCQB:ESPH) is a company that has flown under the radar for quite some time. This is understandable as the water market is filled with its share of microcap water plays such as AWG International Water Corp (OTCQB:AWGI) and Bioshaft Water Technology, Inc. (OTCQB:BSHF). With a return on assets of -854.96% and -373.35% respectively, it puts into perspective just how risky a seemingly stable industry can be - and how well Ecosphere stands out against the competition.

Ecosphere Technologies (Ecosphere) has not been without its troubles, although these roadblocks in the past present the investor today with an undervalued opportunity moving forward. I will not attempt to cover up Ecosphere's past or current problems as they do present risks to the investment theme, but these stop signs has provided investors with a lower entry point as the company overcomes these difficulties. Ecosphere as an investment offers a multi-faceted investment theme that will undoubtedly reward investors with a clean flow of gains over the next 12 months.

Who Are They And What Do They Do:

Prior to offering the nature of the investment opportunity, it is worth noting what exactly Ecosphere does as a business. Traders may not care, although investing in the water sector is a growing theme that will not be discussed broadly here as I have in other articles in part.

Ecosphere is diversified water engineering, technology licensing and environmental services company. This growing company designs and builds wastewater treatment solutions for use in industrial markets. Moreover, Ecosphere offers a wide range of environmental services and technologies for use in large-scale and sustainable applications.

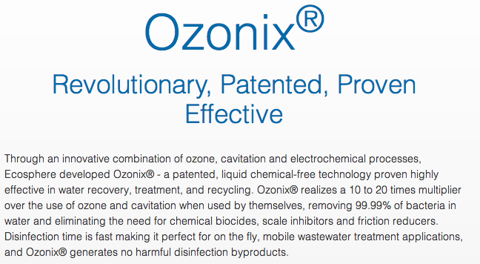

One key product that the company offers is its patent Ozonix(R) technology that can clean and recycle water for use in a variety of industries without using liquid chemicals. The company is further broken down into two main categories.

- Ecosphere Energy Services (EES)

- Ecosphere Exploration and Mining Services

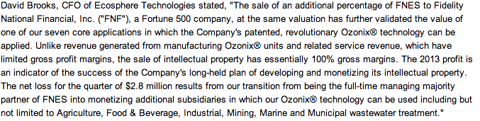

The energy services portion provides high volume mobile water recycling services mainly to energy exploration companies around the U.S. through utilization of the company's Ozonix(R) technology. One key news worthy event here is that since July 31, 2013, an entity by the name of Fidelity National Financial Inc. increased its interest from 31% to 39% in Ecosphere Energy Services LLC, from Ecosphere Technologies Inc. Keep in mind that Ecosphere still maintains ownership of a controlling stake.

Investment Thesis:

- Year over year improvements in financials demonstrates that the company has been improving not only its profitability and its balance sheet, but also its long-term growth.

- The start of the year often provides the highest revenue quarter for Ecosphere, providing a short-term gain as the long-term opportunity plays out.

- Ozonix(R) Technology serves a key market in the U.S., and is extremely unique to the marketplace and has been highly successful. Moreover, Ozonix has only recently been released to licensing opportunities presenting an opportunity for future growth.

- Future of the company is broad and extensive - serving multiple industries.

- The company is expanding its scope to newer technologies and is protecting those innovations with patents that present a legal barrier to entry that the company controls.

- The company has been the recipient of several awards for its innovative technologies.

- Institutions have been loading up on shares, and insiders in the company have also made significant purchases outlining that the latter is not only investing other people's money, but their own as well. Although institutional ownership is low, it provides for institutions to increase their positions that can boost the PPS long term.

- Risks that can affect Ecosphere in the short term and technical analysis on when to buy.

- Recent earnings and PPS target.

- Conclusion

Thesis Items Expanded:

Financials:

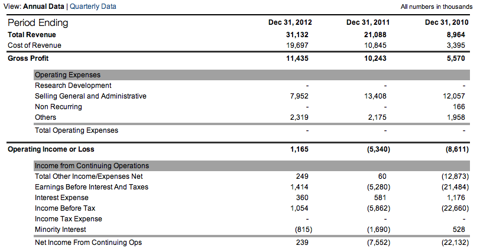

(Click to enlarge)

(Click to enlarge)

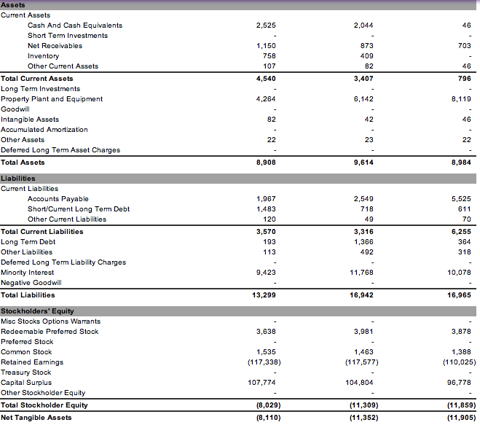

Ecosphere has done well to improve its income and profitability on a year-over-year basis. Total revenue has nearly quadrupled from $8.9 million in 2010 to $31 million in 2012. Operating income has been positive for the first time in 2012 after negative values for 2010 and 2011, and net income has been positive for the first year as well. Keep in mind that these improvements have taken place as the share price has declined in the past two years from $0.37 to $0.25 where it stands as of the writing of this article. Compounding the belief that on a year over year basis the PPS has not kept up with the company's improving financials and is due for a readjustment.

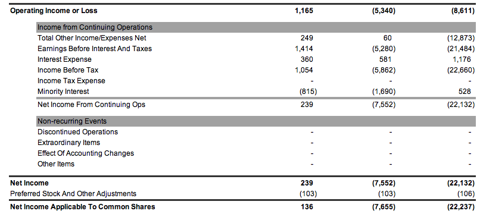

(Click to enlarge) As stated earlier in this article, there is no reason to hide the negative aspects of an investment. They should be known and understood to an investor so they know exactly why a company is where it is today. It all comes down to the balance sheet and Ecosphere still has some work to do. The company has significantly increases its cash holdings, current assets while decreasing its total current liabilities over the past two years. Total liabilities have been on the decline as the company's capital surplus has canceled out its negative retained earnings, although the company has to obtain a positive stockholder equity and net tangible assets. The company is on its way, although this is a long-term plan and I would not expect the company to obtain positive shareholder equity until at least 2015. Although this does not hamper EPS and PPS growth in the interim, it does present an obstacle that could be the reason for the low PPS as the company is going to need a longer timeline to obtain a positive shareholder equity value.

As stated earlier in this article, there is no reason to hide the negative aspects of an investment. They should be known and understood to an investor so they know exactly why a company is where it is today. It all comes down to the balance sheet and Ecosphere still has some work to do. The company has significantly increases its cash holdings, current assets while decreasing its total current liabilities over the past two years. Total liabilities have been on the decline as the company's capital surplus has canceled out its negative retained earnings, although the company has to obtain a positive stockholder equity and net tangible assets. The company is on its way, although this is a long-term plan and I would not expect the company to obtain positive shareholder equity until at least 2015. Although this does not hamper EPS and PPS growth in the interim, it does present an obstacle that could be the reason for the low PPS as the company is going to need a longer timeline to obtain a positive shareholder equity value.

(Click to enlarge)

The above values show the recently quarterly data with the most recent quarter ending September 30, 2013 on the left, moving to older quarters to the right. Working off the annual data in a more specific light, the company has been rapidly improving its shareholder equity quarter-over-quarter. The most recent quarter may be cause for concern on the decline. Although I would like to point out that the company's highest revenue quarter will be reflected next quarter, and the latest quarter shown above, ending September 30, is usually one of the company's lowest revenue quarter. Pointing out that a cyclically lower revenue quarter for the company still reflects on the balance sheet as a shareholder equity number keeping up with the past quarter is good news.

(Click to enlarge)

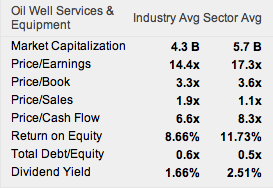

Ecosphere's financials do not stop at the balance sheet and income statement as other key statistics. With a debt/equity ratio of 0.05x and a debt/assets of 0.04x the company is not overleveraged with regard to debt. With most microcap companies, debt can be a deterrent for investment. Moreover, Ecosphere sports a quick ratio of 1.95x, pointing to its comfortable financial position.

According to the company's valuation, its P/E ratio of 1.70x is lower than 90% of other companies in the Oil Well Services & Equipment industry. A price/cash flow of 0.37x points to the company's undervalued nature with regard to cash flow. On the other half of this glass of water, with a price/sales of 2.57x and a price/book 2.23x could be deterring to the quick look. Although this is only the high end of the middle range of 2.03x for price/sales and just over the high end of the middle range of 1.94x for price to book for the industry. So Ecosphere is not overvalued compared to its peers on a valuation aspect, a key point benefit even while keeping its microcap size.

Now is the time to assert some of the very positive aspects of management's effectiveness on a trailing twelve months basis. Keep in mind that a microcap company has an easier time providing fantastic gains, although they are certainly interesting nonetheless.

- Return on Assets: 130.89% (TTM)

- Return On Equity 480.24%

- Return On Invest. Capital 256.69%

To put this into more perspective in comparison to the industry, Ecosphere is able to reinvest its earnings more effectively that 100% of its competitors in the Oil Well Services & Equipment industry.

- EPS Growth Rate 2,051.20

Ecosphere's earnings per share growth is also greater than 100% of its peers in the industry.

- Gross Margin 34.57%

- Operating Margin 151.95%

- EBITDA Margin -19.76%

- Net Profit Margin 151.25%

Moving over to profitability, Ecosphere's gross margin is in line with its industry. This means that the company has a comparable amount of cash to spend on operations as its competitors. Furthermore, looking at Ecosphere's operating margin controls its costs and expenses better than 100% of its peers.

I would like to point out again, that this company's financials and financial improvements have taken place as the stock has gone down from $0.37 two years ago and down from $0.49 three years ago - presenting an investment opportunity at undervalued levels.

First Quarter Is The Best Quarter

(Click to enlarge)(Source: E*TRADE)

The above chart pinpoints the concept of Ecosphere's higher revenue per share at the start of the year - the first quarter. Keep in mind that the total amount of shares has increased over this yearly period, so the EPS per share would be lower over time as the amount of shares has increased. Although keep in mind that above, for the quarterly data, the most recent quarter is usually the worst quarter for the company - although income and revenue has reflected over into the balance sheet a shareholder equity number that has kept up to par with recent numbers.

(Click to enlarge) (Source: E*TRADE) Moving from 2008 to 2012 on the right, the number of outstanding shares puts the revenue per share chart into more perspective. Cemented by the earlier figures of improving YoY revenue numbers for Ecosphere. I expect the first quarter of 2014 to be a huge revenue quarter for the company both cyclically and with the roll out of its Ozonix Technology.

Moving from 2008 to 2012 on the right, the number of outstanding shares puts the revenue per share chart into more perspective. Cemented by the earlier figures of improving YoY revenue numbers for Ecosphere. I expect the first quarter of 2014 to be a huge revenue quarter for the company both cyclically and with the roll out of its Ozonix Technology.

Ozonix(R) Technology:

(Click to enlarge)

Back on September 3, 2013, Ecosphere announced that is would be licensing its Ozonix(R) water treatment technology on a global scale. This Ozonix(R) technology is available to every industry using chemicals, such as chlorine, to disinfect water. This technology is available for various applications across a wide spectrum of industries.

(Click to enlarge)

- Agriculture

- Food and Beverage

- Industrial

- Mining

- Marine

- Municipal Sewage Water Treatment

The company's technology may be new to licensing, although it is not new to the world. George Chaps, Director of New Business Development for Ecosphere has stated that the company's technology has been in use since 2008.

"As a result of our patented Ozonix® technology being used to treat over 3 billion gallons of water in the U.S. hydraulic fracturing industry since 2008, we are bringing awareness to some of the world's top engineering firms of the benefits and capabilities that our broad-spectrum advanced oxidation process can provide to the various industries in which they operate."

Expanding on less specific items, the company itself offers a longer list of countries that Ozonix(R) can be licensed in, and the non-energy applications that the technology can be used for.

Ecosphere's patented Ozonix® technology can be licensed in every major country and region around the world (North America, Central America, Latin America, the Caribbean, Europe, the Middle East, Africa, Asia Pacific, East Asia, India, Japan, Greater China) for all non-energy related applications including but not limited to grain growing and processing, landscape irrigation and runoff, sludge processing, surface water treatment, soil and groundwater remediation, storm and drainage water treatment, aquaculture and fish farming, breweries, drinking water, vineyards, dairy, butter and cheese processing, livestock farms and feedlots, fruit and vegetable production, sugar production, automotive, pharmaceutical, biotechnology, pulp and paper, leisure and water parks, textiles, manufacturing, microelectronics, material waste management, acid mine drainage, mining process water treatment, metals and minerals, tailing ponds, leaching and recovery, aquariums, ballast wastewater treatment, marine process water, on-board grey water and municipal sewage wastewater treatment.

Moving over to the company's legal barriers to entry, the company owns five approved patents and has many pending in the U.S. and internationally to protect its innovations. Dean Becker, Director of Ecosphere and CEO of ICAP patent Brokerage and ICAP Ocean Tomo Auctions has stated that the company has a strong front on its IP and its licensing opportunities. Protecting a company's business innovations, technology and property is key to product differentiation form a company's competitors to ensure future success from a unique product. Think, Twitter (TWTR) only owns three patents - a statistic that may be a problem.

"From an intellectual property standpoint, Ecosphere holds a dominant position in combining multiple advanced oxidation technologies to treat bacteria in the many industries where carcinogenic chemicals are currently being used to eliminate bacteria," stated Dean Becker, Director of Ecosphere and CEO of ICAP Patent Brokerage and ICAP Ocean Tomo Auctions. "With five U.S. patents approved and dozens of U.S. and International patents pending, Ecosphere is well-positioned to strategically partner with companies that have the financial resources and geographic reach to successfully introduce the proven Ozonix® technology to their respective customers and markets."

An earlier statement in this article states a partner, Fidelity National Environmental Solutions, FNES for short, which Ecosphere has in its business. This partnership is a key aspect to the company's current and future success in brining its Ozonix(R) to applications all over the world. Dennus McGuire who is Chairman and CEO of Ecosphere has stated that this partnership is very valuable to Ecosphere's rollout of Ozonix(R) now and in the future. FNES is a division of Ecosphere.

Dennis McGuire, Chairman and CEO of Ecosphere, stated, "We now have a world-class partner in Fidelity National Environmental Solutions and the infrastructure in place to develop the global energy market. As a result, we are focusing our efforts on bringing Ozonix® to the dozens of other applications in every city and country around the world where industry and its surrounding communities can together benefit from lower water treatment costs, reduced chemical usage and preservation of vital water resources. We look forward to working with some of the world's most forward thinking companies to bring Ozonix® to the global water treatment market."

(Click to enlarge)

Ozonix(R) is a complex technology that is not only innovated, it is patented. Ozonix(R) is a multi-step process, which is very interesting. Understanding a company's main product is the first step to understanding an investment.

The first step in the process is ozone that breaks cell walls and oxidizes components to break bacteria cell walls apart. Ozone purifies water 3000x faster than chlorine (chemical used primarily in water utilities around the United States), and does not have to be stored.

The second step in the prices is hydrodynamic cavitation that raises the water temperature to cause chemical reactions that sports an oxidation potential of 2.8V. This is accomplished in seconds compared to minutes in comparison to Chlorine, which needs significant time to take effect.

(Click to enlarge) The third step of the process uses sound waves to raise the waiter temperature to over 900 degrees Fahrenheit again. This acoustic cavitation causes shock waves to cause sonochemical reactions to occur. This process is extremely effective in removing biofilms.

The third step of the process uses sound waves to raise the waiter temperature to over 900 degrees Fahrenheit again. This acoustic cavitation causes shock waves to cause sonochemical reactions to occur. This process is extremely effective in removing biofilms.

The last step in this four layered process used electrochemical oxidation that utilizes electricity to remove sulfides, nitrogen species and up to 99% of iron in water sources. Moreover it is extremely effective in removing calcium carbonate form water. In a world that has a water source with a growing amount of pesticides, antibiotics and other contaminants - a reliable purification system is more than necessary.

The last step in this four layered process used electrochemical oxidation that utilizes electricity to remove sulfides, nitrogen species and up to 99% of iron in water sources. Moreover it is extremely effective in removing calcium carbonate form water. In a world that has a water source with a growing amount of pesticides, antibiotics and other contaminants - a reliable purification system is more than necessary.

(Click to enlarge)

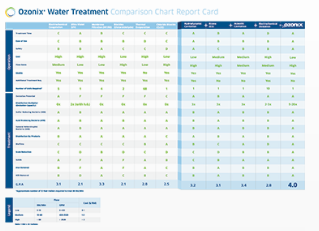

Look, we live in a world with a trillion and one technologies for every part of life. As an investor, you should be skeptical of a company's claims with regard to its technology offerings.

Above, you can see just how well Ozonix(R) stacks up against the competition, and its competitive advantages in the marketplace.

Future of Ecosphere as a Company

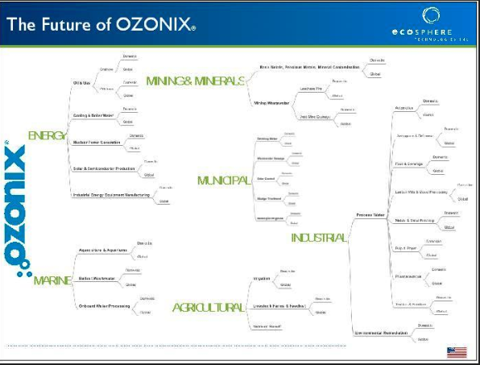

(Click to enlarge)

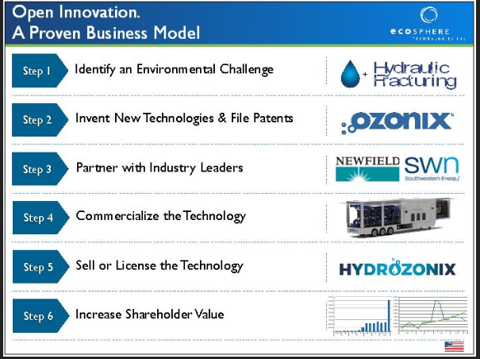

Ecosphere has a simple, and proven business model that they have been working of off for many years.

The company's technologies is a solution to meet some needs of the globe's water issues, serving multiple industries.

(Click to enlarge)

The company has its sights on and is currently doing business in a wide range of industries, so its profits are not tied to one specific industry. Moreover, these industry breakup into sub-components that the company serves. Diversification in its provided services offer stability, as changes in one sub-sector will not break the bank on the company's profitability.

New Technologies

Outside of Ecosphere's innovative Ozonix(R) technology, the company has its hands on other innovative areas. Recently on November 26, Ecosphere received a U.S. patent for its mobile solar power system.

- Ecosphere's PowerCube(R) is a portable, self-contained micro-utility that uses solar power to provide electricity in the most remote, off grid locations.

Moreover, the product is designed to meet the growing demand for off-the-grid energy.

- The PowerCube(R) maximizes solar power generation possible in 10'. 20' and 40' standard ISO shipping container footprints.

The PowerCube(R) can generate power up to 15 KW, to support off-grid military, disaster relief, humanitarian and mobile communication efforts. Moreover, the invention is patented and can be transported by land, air or sea. I expect the new PowerCube to generate profits for the company in the coming quarters, and since it is new is has not been included in past quarters income.

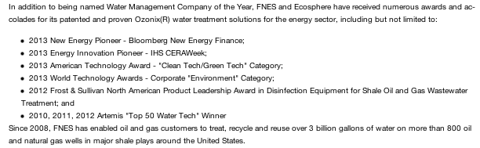

Awards

Ecosphere and its technologies have not flown under the radar as its stock price has in recent time. The company and its subsidiaries have received several awards in recent time for its innovations and technology.

- October 31, 2013 - Fidelity National Environmental Solutions (FNES), a subsidiary of Ecosphere, was named water Management Company of the year in the Midcontinent Oil & Gas Awards.

To clear up FNES, Fidelity National Environmental Solutions is a leading water treatment provider to the energy services market and has an exclusive field-of-use license for Ecosphere's patent Ozonix(R) technology for global energy applications. On the company's website, FNES is listed as a division of Ecosphere.

- Ecosphere Technologies selected as finalist for the World Technology Awards on September 24, 2013.

(Click to enlarge)(Source )

The company and its divisions have received several awards for its patented technologies. Pointing to the fact that the company is not hoping or dreaming for success with its products, as they have been awarded by society many times over.

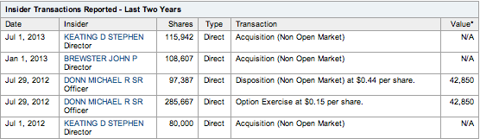

Institutions and Insiders:

Ecosphere's management is not only confidant in the company they work for, they are investing their own money in the company.

(Click to enlarge)

Management taking a stake in the company is one way to solve the principal agent problem and it also shows that management has a stake in the game. Insiders have been purchasing shares lately.

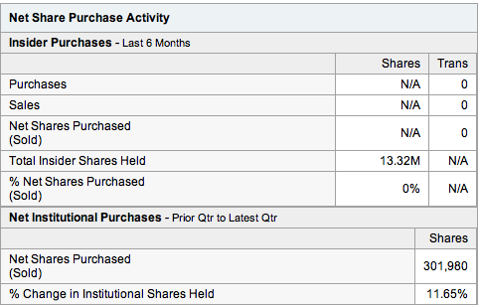

(Click to enlarge)

Insiders have also stressed their buying with an 11.65% increase in institutional shares held one quarter over quarter basis. Keep in mind that institutions still own under a percent of the company, so the company is still under bought at the institutional level. Increased insider and institutional buying demonstrates both parties drive to own a piece of the company.

Risks and Technicals

Ecosphere is a microcap company, and as such the small nature of the company can be the target of significant swings in share price - as can be seen in Wednesday's (12.85%) movement with no news. Average volume of 112,883 shares traded per day on a three-month average basis indicates liquidity so the stock is not illiquid.

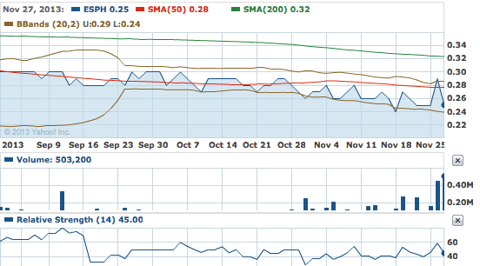

(Click to enlarge)

Ecosphere is below both its 50 and 200 day moving averages of $0.28 and $0.32 respectively. With an RSI of 45, below the neutral 50 range, the stock is slightly oversold as well. Moreover, with narrowing Bollinger bands on a three-month period I see $0.25 as an excellent entry point as the technicals are not favoring downside. As such, a technical entry of $0.25 can offer significant opportunity for the long-term theme to come into fruition.

Again, I would like to remind investors of the risks involved in such a small company. Being a microcap company can lead to large increases or decreases in the PPS and has the potential to hurt your portfolio. So before investing in a microcap company, make sure the investment is right for you and you have completed all of your due diligence on the company.

Recent Earnings:

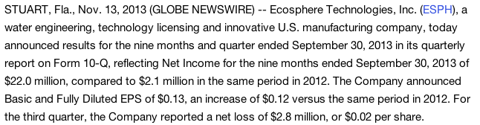

(Click to enlarge)

Ecosphere reported Q3 2013, YTD net income of $22 million and EPS of $0.13, this results to an increase of $19.9 million and $0.12 over Q3 2012 YTD. This shows the company's rapidly improving financials not only on an annual, but a quarterly basis.

Ecosphere will grow substantially over the next year, as it is currently undervalued to begin with in comparison to the industry. With a P/E of 1.7x, and a p/cash flow of 0.37x the company is significantly undervalued in comparison to the industry. I believe growth is possible due to the company's rollout of Ozonix(R) licensing on a global scale and its competitive advantages, the introduction of PowerCube(R), the company's extreme ROE, ROA and ROIC coupled with its solid margins. Pointing strictly to the company's management effectiveness growth - the company will grow at a steady rate over the next twelve months. When coupled with the recent rollout of Ozonix(R) licensing on a global scale and the introduction of PowerCube(R) - these patented and extreme competitive advantages will be a huge success in the marketplace will result in solid sales and profits for the company. Keep in mind that investing in Ecosphere will be ahead of the real rollout of these two products, offering an investor an amazing opportunity to capitalize prior to these items' reflection in sales and profits numbers.

Risk 2: Caveat In The Recent Earnings Numbers

Although the annual financial numbers are unaffected, there was a substantial one-time gain that the company incurred for sale of part of one of its divisions. Ecopshere sold an additional percentage of its ownership of FNES to Fidelity National Financial, Inc or FNF for short. The company has state that this is a valuable sale since intellectual property has 100% gross profit margins instead of revenue generated from Ozonix(R) which have limited profit margins.

The company has stated that they retain 100% of the global rights to monetize its patented Ozonix(R) technology in all other non-energy related water treatment industries and plans to realize similar value as recently realized from the development and sale of its ownership interest in FNES.

Dean Becker, Director and Intellectual Property Strategist for Ecosphere Technologies went on to state how this IP monetization is just the start of its global efforts.

Becker added, "The application of Ozonix® in the energy field-of-use is just the start of a long-term intellectual property monetization strategy of inventing, patenting, innovating, manufacturing and successfully deploying our intellectual property assets across numerous industries around the world."

I would likely to heavily assert to investors that this transaction was a major driver of the company's recent earnings call. Although generally a dull quarter, it does have a large impact. Moreover, I would not quickly take away these numbers as the company has stated (above) that this is just the beginning of its IP monetization strategy moving forward. As such we will likely see more transactions like this. Outside of this transaction, the company's annual numbers are still interesting enough.

Conclusion:

Ecosphere offers the investor an interesting short and long term play in the water industry. On a short-term basis, the stock is ripe to buy.

- The technicals do not point to any downside, and do point to a return to a PPS at or above the 50 and 200 day moving averages.

- The first quarter of the new year is usually the largest revenue period for the company, which will likely boost the share price.

On a long-term basis, Ecosphere offers the investor an even more compelling investment opportunity.

- The rollout of global licensing for Ozonix(R), and its many competitive advantages that serve a large amount of industries and sub-sectors. Moreover, this technology plays into the water theme of a growing polluted water supply.

- The introduction of PowerCube(R) will serve off-the-grid energy needs for the future.

- Both Ozonix(R) and PowerCube(R) are patented, and protected.

- The company's financials, balance sheet and income statement are rapidly improving on an annual and quarterly basis.

- The company and its subsidiaries have been the recipient of many awards for its innovative technologies - thus the market has verified the technologies value.

- The company's future is broad and extensive, so its profits now and in the future are not linked to any one specific subsector.

- The company is expanding its technologies to new areas that can be seen with the PowerCube(R) and are protecting these products with patents.

- The licensing rollout of Ozonix(R) and PowerCube(R) do not reflect in current financials, offering an opportunity to invest before they are reflected in the company's financials.

- Institutions have been increasing their position in Ecosphere, although still represent a minute ownership level - so this holding value can grow as can be seen on a quarter-over-quarter basis. Insiders have also purchased shares recently. Both parties buying shares can increase the PPS long term, and the former demonstrates institutions drive to invest in Ecosphere and the latter portrays management's desire to own the company that they run.

With regard to risks, the company also has its share.

- Then company is a microcap stock, and is subject to increased volatility and uncertainty.

- The company's recent earnings were driven by IP stake sales. Although we will likely see this again and its not exactly a negative - it is keen to keep this earnings driver in mind as it is outside organic growth.

Being a microcap company offers the usual risks to the company. Moreover, the market will have to accept these new products in the marketplace - as they have with Ozonix®, although we will have to see for PowerCube®. I am confidant with my thesis that Ecosphere is set to outperform the market. 2014 will likely be a major rollout year for the company and this will be reflected over the coming quarters and especially at the end of next year. The water market is a fragmented market, with various companies offering specific needs for the growing water challenges facing the world. Instead of searching for a broad based play on the water market, I have focused my efforts on Ecosphere, a microcap water technology company with a promising future.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in OTCQB:ESPH over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: Always do your own research and contact a financial professional before executing any trades. This article is informational and in my own personal opinion. Understand the risks of micro-cap stocks as well before investing, as they are subject to increased volatility and uncertainty.

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1869361-ecosphere-technologies-inc-a-diversified-water-engineering-company-with-significant-long-term-upside-potential?source=feed

Aucun commentaire:

Enregistrer un commentaire