High Arctic Energy Services (GM:HGHAF) is an oilfield services company with operations in Canada and Papua New Guinea. In Canada they own snubbing equipment, provide nitrogen transportation and pumping, and run an long reach service rig. In Papua New Guinea, they manage two drilling rigs, own and manage a workover rig, and provide rentals of ancillary products to oil and gas companies, most notably rig mats.

High Arctic Energy Services (GM:HGHAF) is an oilfield services company with operations in Canada and Papua New Guinea. In Canada they own snubbing equipment, provide nitrogen transportation and pumping, and run an long reach service rig. In Papua New Guinea, they manage two drilling rigs, own and manage a workover rig, and provide rentals of ancillary products to oil and gas companies, most notably rig mats.

Valuation

High Arctic's current assets (mostly cash and high quality receivables) exceed the company's total liabilities including all debt by $28 million. Subtracting that from the company's market capitalization of $159 million at a recent share price of $3.20 CAD, leaves the company with an enterprise value of $131 million. The company has trailing twelve month [TTM] earnings of $24.1 million, for a cash adjusted P/E ratio of 5.4.

The market is penalizing the company for it's operations in Canada which are subject to gas prices and its operations in Papua New Guinea which are subject to political risk and customer concentration. These contract renewal and pricing risks are very similar to the situation in Awilco Drilling (OTCPK:AWLCF) when I wrote the first Seeking Alpha article on that stock in June. Awilco is up over 40% since my article, and many of the same factors apply here. In both cases a disruption to a major asset or contract termination would be a huge negative for the stock, however, due to the low valuation the upside potential is significantly asymmetric to the downside risk.

Even in a downside scenario where the company lost 50% of its income, it would not be unreasonable for the company's P/E to expand to 8-10X, meaning the stock would be down only slightly. With the mega-cap oil service companies trading at 12-14x earnings, it would not be unreasonable for High Arctic to trade at 8x earnings, allowing an ample discount for size and liquidity discounts. That provides a price target of $4.41, for a 38% increase from the current stock price.

The company also pays a well covered dividend of $0.15 per year (paid monthly). This demonstrates management's confidence in the sustainability of their cash flows and provides a return of capital to shareholders. Adding the dividend to the price target above suggests a 42% total return is achievable.

The company has very little debt, with only $6 million outstanding, and a large cash balance. This provides significant financial flexibility to the company, allowing it to invest in high return on capital assets and have the flexibility to weather any future storms in demand.

Operations in Papua New Guinea

The company's operations in Papua New Guinea are conducted significantly under long term contracts. For example, the company's two drilling rig contracts do not expire until the end of June 2016, and the workover rig is contracted until May 2014. High arctic also owns 5 camps which are fully contracted, as well as cranes, trucks, forklifts, and over 9000 rig mats. The demand for these services in Papua New Guinea is significant, as oil field service sector is underdeveloped in that country compared to its potential. This has led to high demand for the company's products and services. This is evidenced by the 20% increase in the company's Papua New Guinea revenue to $85.9 million for the first 9 months of the year compared to $71.2 million for the same period in 2012.

Oil Search Internation (OTCPK:OISHF) is the company's largest customer in Papua New Guinea, and owns the two drilling rigs the company manages. A significant risk has come out of the stock with the renewal of these contracts in the summer. This validates the commerciality of the company's assets in Papua New Guinea. It is worth noting that OISHF is an Australian company with a market cap of over $8 billion, so their ability to make payments as required should not be in doubt.

The market is over compensating for country specific risk in Papua New Guinea. The country is a parliamentary democracy and a member of the Commonwealth, with a judicial system modeled after that of Australia. Although political risk does exist, the company's assets are mobile and could be transported out of the country in the event of political instability. This type of country risk is much greater for a producing company, as the reserves in the ground are not portable, whereas servicing equipment (such as the company's helicopter transporter rigs) would have value in another country if Papua New Guinea became untenable.

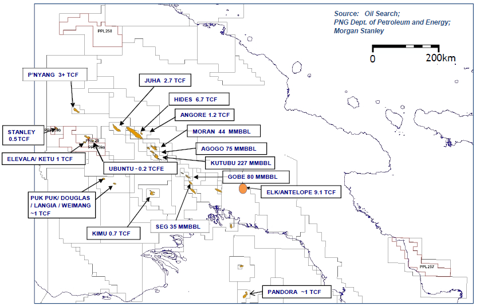

The other type of risk to a basin is geological risk. If exploration companies no longer wish to drill wells in Papua New Guinea that will reduce demand for the company's services. However, a number of recent and good sized discoveries suggest that exploration will continue. In addition, natural gas prices in Papua New Guinea are higher than prevailing prices in the United States, and LNG export facilities do exist. These factors continue to encourage additional exploration drilling, and a string of successes will improve rig utilization of the company's service rig when discoveries (such as the recently successful Tingu-1 well) move towards the development phase. A map of discoveries suggests that oil and gas drilling in Papua New Guinea should continue for some time.

Source: Eaglewood Energy Corporate Presentation

Investor's are naturally cautious of investing in assets in Papua New Guinea, and the constitutional crisis in that country over who had the right to be Prime Minister in 2011-2012 damaged the country's international reputation. However, the crisis has been resolved and the government is currently stable. And besides, even the most mature democracy's have the odd contested election. (Hanging chads in 2000, anyone?)

Operations in Canada

The company's operations in Canada have declined since 2012, and are currently generating revenue at approximately 2011 levels. This is primarily due to their exposure to gas prices in their snubbing division. As they transition equipment to oil areas and other types of work (abandoning shallow gas wells) this focus should become less of a negative. Additionally, the revenue decline in Canada has been more than offset by revenue increases in Papua New Guinea, where the company is focusing its capital spending. The Canadian operations are not expected to be a large source of growth, but at the current valuation the company does not need to grow to be an excellent investment. In addition, the Canadian operations provide a long dated call option on North American natural gas prices at essentially no cost.

Conclusion

High Arctic is a deeply undervalued company because its assets are in unpopular areas. However, those assets are highly profitable and revenues are contracted for years. The company is relatively illiquid in OTC trading, but has significantly better volume in Canada where it trades under the symbol HWO. All values in this report are in Canadian dollars, as the company reports in that currency.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in GM:HGHAF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868501-high-arctic-energy-40-undervalued?source=feed

Aucun commentaire:

Enregistrer un commentaire