GE (GE) stock has exceeded even my more optimistic expectations since I wrote about it 3 months ago. Its 16% ascent in that time frame (when the S&P went up about 10%) testifies to the fact that there were significant stock-specific elements to the positive performance. Has GE gone too far too fast? Has the buy thesis on GE changed? While it isn't quite as compelling a value now as then, I give you four reasons why I still consider it a buy.

- From Retail to Industrial. GE surprised the market over the last month with plans of divesting much of the GE Finance business. This has the twin benefits of divesting when the pricing on Financials is turning for the better, as also enhancing the stock appeal of GE to investors. As a representative of major investor TIAA-CREF points out - Investors value financial-type earnings less than they value industrial-type earnings. GE will get more stock 'P' out of a dollar of 'E' as an industrial. Given that GE is making the case that the divestiture will be EPS neutral, this should be both a near and medium term positive for GE.

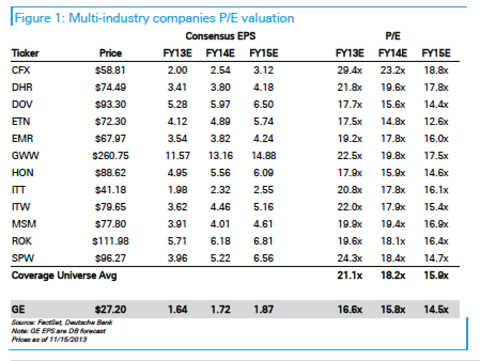

- Good Relative Value. Once GE gets accepted and modeled as an Industrial, its valuation seems reasonable (see Figure below) compared to Emerson (EMR), Danaher (DHR) and Honeywell (HON), three companies that are similar in terms of international reach and product diversity. The recent Danaher upgrade is suggestive of tailwinds for industrials as a whole. The fact that the Industrial Select Sector SPDR (XLI) handily outperformed the S&P over the last 6 months (see below), suggests that the market is picking up on Industrials as a favored sector.

- Insider Buy. It is fairly rare to see an insider buy in GE, and director William Beattie's past buys in the $19 and $21 ranges have worked out fairly well for those who could match his buy price. Beattie's latest buy at $26.88 is thus significant, both for those anxious with GE stocks rise over the last 3 months, and for those looking to include it in their portfolios.

- Move to Megacaps. For the last 5 years, the word 'Megacap' has been a mild negative, signifying fragmented businesses and execution miscues. To the extent that the future of the market is in the hands of 'bond rotators' (conservative bond investors who are migrating to stocks only reluctantly), the size, name recognition, and solid dividend of a Megacap such as GE will be a positive.

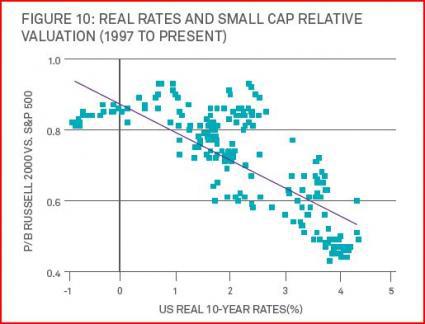

- Taper Protection. While we debate fiercely about the timing and extent of the taper, most of us accept that it will happen at some point - and lead to a rise in interest rates. As the chart below shows, that plays into the hands of large caps such as GE.

In short, GE is a higher stock than a few months ago, but also a better company. The stock market highs notwithstanding, there are stock-specific, fundamental and macro reasons why you may want to be invested in GE. I stick to my earlier price target in the low to mid-$30's for 2014. If the market gets rocky next year, the 15-20% total return that would lead to will look quite desirable.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1869251-ge-reasons-for-cautious-optimism?source=feed

Aucun commentaire:

Enregistrer un commentaire