As we head into the home stretch for 2013, it seems like a good time to review the status of the stock market's current trading momentum and the most likely direction for the rest of the calendar year.

Heading into Friday's half-session, the indices are all short-term overbought, but only the Nasdaq is really in the danger zone. I'm actually hoping for the usual post-Thanksgiving Friday rally - whose main basis is that it usually rallies - because that would leave everything overbought enough to take the short side. I wouldn't expect anything drastic before next Friday, though. The market is apt to trade in a limited range next week, relieving some of the short-term pressure, until the November jobs report arrives at the end of the week.

On both an intermediate and long-term basis, the markets are dramatically overbought, at least from a technical point of view. That they are at extremes over both time horizons argues for something along the lines of at least a few percent pullback before year-end.

Against that is the unmistakable sense of seller capitulation as we head into December. Investment luminaries like Barry Sternlicht and Stanley Druckemiller, two men who had expressed doubts about the fate of the rally previously (Druckenmiller said last year it would all end in tears eventually), have backed off a bit and made it clear that they don't intend to miss the last leg of the market's move upward. They and other would-be sellers may be more worried about missing a last parabolic leg than missing the start of a big decline.

The two main hurdles the S&P 500 has to cross on its way to reaching the magic 30% mark (the market loves round numbers) are linked - the November jobs report and the December FOMC meeting. Going by the pattern that Bureau of Labor Statistics (BLS) data has shown so far this year, especially after the preliminary benchmarking, I would guess that the November report favors another 200,000 gain. I've written several times this year on the theme of BLS estimation methods possibly overfitting the data sampling, but I certainly don't expect them to change direction until the annual benchmarking in February.

At times like this I long for the days when the late, great Mark Haynes would forcefully remind CNBC guests that employment is a lagging indicator (which he did throughout 2007). However, that isn't immediately relevant to the remainder of 2013 - what matters more is whether the headline numbers are strong enough to make the market fear a December taper.

The FOMC statement is on the 12th, so there is time to speculate on that later, though I'll repeat my usual party line here that guessing policy decisions is a mug's game. While there is always the chance of unexpected events intruding into the market's private party, the central bank's statement is undoubtedly the focal point for whether the market roars into the end of the year or not. Market sentiment has completely abandoned itself to the notion that either QE is all that matters, or it's all that matters to "everyone else."

As an investment professional, I'm somewhat embarrassed to say that the actual amount of QE dollars has little if any relevance these days. What matters is the change in the flow rate, not the actual volume. Whether it's $40 billion or $85 billion matters very little to the real economy, though it could matter later when the Fed has to unwind its balance sheet. The only remaining magic to $85 billion, if there ever was any, is that it's the number the Fed started with. Any deviation from that is going to lead to a market reaction - whether the Fed had begun with $40 billion or $60 billion or $100 billion, all that matters now is the symbolic value of the next change in speed.

Despite the overbought nature of the market, the chances for a parabolic blow-off remain intact. While I lean towards fourth-quarter real GDP falling back below 2%, the underlying momentum of the economy remains between 3% and 4% nominal growth. My own work indicates more stall speed data is in store, which should not matter to the market in the short run, even if it means termites eating away at the long-term foundation.

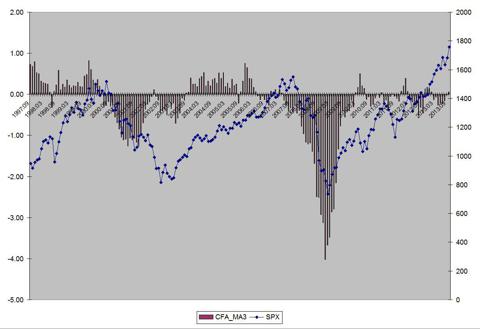

Here is the latest update to the chart showing the S&P 500 and the Chicago Fed national activity index.

The divergence gets scarier to me every month, but it's the kind of thing that the stampeding herd always, always ignores. Afterwards, it makes asset managers wonder what in the world they were thinking.

The possibility of no taper until March means the market could still explode to the upside over the months remaining before then. The fact that the Nasdaq pulled off its infamous doubling between October 1999 and March 2000 is something that the Druckenmillers of the world haven't forgotten, and they don't intend to miss the sequel.

Before that possibility has you jumping up to hit the buy button, do keep in mind that a December taper will bring things to an abrupt halt, and that policy decisions are never to be taken for granted. With that in mind, you might want to jigger your portfolio away from the small-cap and tech sectors in favor of the iShares Spyder (SPY) or one of its equivalents.

The reasons for that are that one, the first two sectors are definitely more overbought, and two, small caps in particular are going to be more vulnerable to rebalancing selling as we approach the end of the year. The selling might not be enough to keep a lid on further gains, but should be enough to favor big-cap outperformance. In addition, if there is a December taper, you would much rather be in large caps, though not so much high-yielding dividend plays.

If there is no December taper, the biggest melt-up possibility is in the Nasdaq again. On a technical basis, it's about a dangerous a place as you can be, but that was the case in 1999, too, and the index blew through every failsafe. The Nasdaq is the home of the New Nifty Fifty (more on that later) and most of the hottest IPOs - you might see hot money rush to not miss the new parabola, figuring that there is no real danger until the taper.

That mindset is the stuff of big bubbles and big collapses, but there is one thing you can always count on - traders and the retail public will always fear missing the former more than getting caught by the latter. It's after they all get caught that they start to worry again.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868191-up-up-and-away-almost?source=feed

Aucun commentaire:

Enregistrer un commentaire