Bank of America (BAC) has reached a new 52-week High at $15.88 on November 26, 2013 and shares have nearly tripled over the last two years. BofA stock is now quoting at $15.82 and sitting just below its recent High waiting for further impulses. With shares gaining momentum investors might ask whether an investment in Bank of America still makes sense.

I think a variety of reasons speak for a long-term investment in Bank of America and the company remains significantly undervalued given its strong fundamentals:

- I believe we are still in the expansion phase in the business cycle. Corporate profits and margins are decent, but interest rates and inflation are still low and unemployment remains stubbornly high. Corporate profits are supported by the aggressive monetary policy of the Fed and banks, especially large-cap banking franchises like Bank of America with huge deposit bases, are prime beneficiaries of a low interest rate environment. Banking also is a cyclical business which is set to do well as businesses invest and consumers spend more. Therefore, banking franchises exhibit high levels of business cycle sensitivity: They do extraordinarily well when the economy expands, but does poorly when de-leveraging starts and loan demand contracts.

- After the financial crisis, banks and other financial institutions have been exposed to extraordinary levels of market- and regulator scrutiny. The company has dealt with mortgage related litigation which was widely reported on. It is very hard in such an environment to hide issues that would otherwise raise red flags. Bank of America exhibits a high level of transparency now to which publicized stress test results add.

- Bank of America has dealt with a variety of major issues over the years which materially affected the share price. First off, BofA has settled its long-lasting mortgage dispute with the Federal Government and Attorneys General to help distressed borrowers. Secondly, BofA settled with MBIA (MBI) over soured mortgages. Thirdly, BofA's share price decline in 2011 was at least partially attributable to its dividend plan which was rejected by the FED. The first two issues had been hanging over the share price for a while and have now been resolved.

- BofA currently pays a symbolic $0.01 dividend. However, I think the market still underestimates the very real possibility of a reinstatement of a higher dividend. An improving economy and stronger cash generation could justify a material increase in the cash distribution which then will attract other investor segments in the marketplace. A dividend hike could be a substantial catalyst for shares of Bank of America going forward.

- Bank of America is strongly capitalized. The Tier 1 common ratio according to Basel 1 stood at 11.08% in Q3 2013 vs. 10.83% in Q2 2013 and 10.49% in Q1 2013. Under Basel 3 those ratios amount to 9.94%, 9.60% and 9.52% respectively.

- The run-up in share price has not made BofA unattractive in terms of valuation because the company had been trading at deeply depressed levels which were totally unjustified considering its earnings prospects in a normalized banking environment.

- BofA makes progress with its goal to de-leverage and decrease long-term debt. As of Q3 2013 the company had $255 billion in long-term debt. A year ago, long-term debt balances stood at $287 billion; a y-o-y decrease of 11% and the company expects further decreases in 2014. Reducing debt does not only make the bank less risky but also frees up cash flow that otherwise would have been used to pay interest.

- If BofA's asset quality (as measured by lower provisions for credit losses and lower net charge-offs) continues, Bank of America can quickly achieve $30 billion in normalized (that is, pre-provisioning, pre-tax) income which could give further tailwinds to the stock. Higher revenues and cash flows, lower provision expenses and overhead costs could all boost EPS growth as well as multiple expansion.

- Most importantly, Bank of America is still one of the cheapest large-cap banking franchises out in the field. BofA posted a Q3 2013 tangible book value of $13.62 per share and a total book value of $20.50 per share. In other words, the company still trades at a 23% discount to total book value and at a 16% premium to tangible book value. The resulting margin of safety is significant considering the upside potential the bank has when the economy gains momentum and EPS growth accelerates.

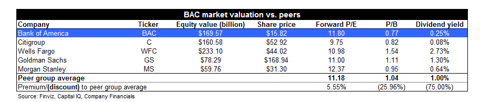

- The company trades at just 12x forward earnings in a sector that still trades at sub-par multiples (see table below).

Conclusion

Despite its great one-year performance and in light of its new 52-week High, Bank of America is still a very attractive, cyclical bank investment that is everything else but expensive. In fact, BofA has one of the largest discounts to book value in the sector. Investors purchasing Bank of America basically bet that EPS growth accelerates as GDP growth picks up and the economy transitions through the business cycle. Unrelenting market scrutiny and a focus on deleveraging have led to a less risky, more transparent banking firm whose earnings prospects are highly correlated with the overall health of the US economy. Investors seeking bank exposure and buy BofA are also likely to profit from the resumption of a meaningful dividend down the road which could be another major catalyst for Bank of America. Given the cyclical nature of banking, BofA's improving asset quality, a strong balance sheet, a low valuation and fantasy being added by future dividends, I rate Bank of America a Strong BUY and wouldn't be surprised if the stock doubles once more over the next 2-3 years.

Disclosure: I am long BAC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1869271-can-bank-of-america-double-once-more-after-reaching-a-new-52-week-high?source=feed

Aucun commentaire:

Enregistrer un commentaire