Mid-Con Energy Partners (MCEP) is an interesting little MLP. Most in the upstream MLP space seek to have a diversified production mix between oil, gas and NGLs. Not so with Mid-Con, which is unabashedly an oil producer. Most other upstream MLPs, including fellow partnerships with parent entities, seek to diversify their geographic holdings. Mid-Con, on the other hand, operates almost entirely in one state, Oklahoma.

Mid-Con Energy Partners (MCEP) is an interesting little MLP. Most in the upstream MLP space seek to have a diversified production mix between oil, gas and NGLs. Not so with Mid-Con, which is unabashedly an oil producer. Most other upstream MLPs, including fellow partnerships with parent entities, seek to diversify their geographic holdings. Mid-Con, on the other hand, operates almost entirely in one state, Oklahoma.

Back on September 7th I wrote an article on Mid-Con, ultimately recommending investors look at several cheaper options in the upstream MLP space. At the time, many of these other names had been put in the discount bin while Mid-Con remained above the fray.

That dynamic has since changed. Beaten down names such as Linn Energy (LINE) and BreitBurn (BBEP) have since recovered a good bit of what they had lost. Not only that, Mid-Con has pulled back. Units are a modest 2% lower than they were on September 7th and 19.4% lower than on their high in October. Many investors are looking for ways to build income, and I believe Mid-Con now offers a good way to do so if one does not mind exposure to oil.

Profile

Mid-Con started its life as an MLP, or Master Limited Partnership, in 2011. Its history as a company goes back further. About 23% of the partnership is owned by privately held Yorktown Energy, which had common founders with Mid-Con through Mid-Con Energy Affiliates. Yorktown has since been steadily dropping its stake. Over 69% of the company is now under public ownership and the founders own a collective 7.8% as general and limited partners. So, while Mid-Con does get most of its acquisitions from "parent" companies, much of Mid-Con is still publicly owned and management interest is aligned with shareholders.

Like most upstream MLPs, Mid-Con has a high distribution yield and distributes most of its cash to unit holders. As of today, Mid-Con yields about 9.15%.

The Waterboys

Water flooding is a secondary recovery method often put to use when primary recovery methods no longer produce economically. In a nutshell, water flooding refers to filling a reservoir with water, which pushes some of the remaining oil to adjacent wells. Mid-Con's expertise is to acquire these mature fields in Oklahoma and then set up water flooding equipment to bring the field back to life. The oily nature of water flooding is why Mid-Con's production is weighted almost entirely toward oil.

Recent Operational Notes

Generally speaking, Mid-Con's goal is to achieve low single-digit organic production growth each year for the next few years. Much of the partnership's growth comes from acquisitions. In the second quarter of this year production actually decreased by 3%. This decrease is the reason behind the decline in price of MCEP units, too.

But there is a method to this madness. Mid-Con is simply taking a plan it had successfully executed nearly a decade ago and doing it again on more recently acquired acreage. This quarter, management has shifted capital spending from drilling wells to drilling water injectors, which will increase water pressure in the reservoirs and should ultimately mean higher production. Management has also converted 8 new wells into injectors, with more plans to do the same in coming quarters. While this plan has sacrificed some current production, in the long run we should see greater production and greater reserves. Management expects a lag time of one year before we see greater production as a result of these injectors.

Finally, management is hinting at an acquisition "sooner than later." As should be expected, details of whatever deal is brewing are not yet available. This deal will most likely be financed by the revolving credit facility, which has a good deal of spare capacity, as we will discuss later.

Strengths and Weaknesses

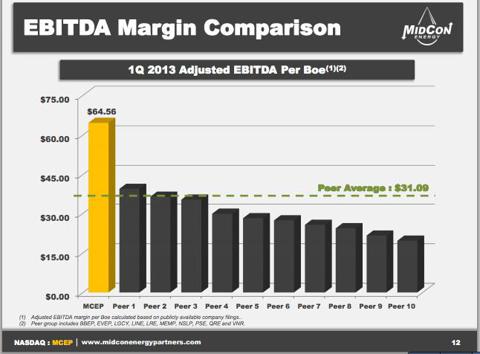

Unique among major MLPs in that the entirety of its production is oil, Mid-Con comes with distinct advantages and disadvantages in this industry. The most obvious advantage is the partnership's superior margins. At today's prices, a barrel of oil equivalent goes for much more than does a barrel equivalent of natural gas. Therefore, Mid-Con's EBITDA margin per barrel equivalent is head and shoulders above the rest.

With oil producers increasingly going for more costly forms of production such as shale drilling and deep water, one would be hard-pressed to find an operator with margins as high as Mid-Con's. It costs Mid-Con roughly $21 to get its oil out of the ground. This means that West Texas Intermediate, or WTI, the price which at which Mid-Con hedges and realizes its production, could drop to as low as $45 and Mid-Con could still get a $20 EBITDA margin for its oil. As of today, WTI sits in the low $90s.

The other side of that coin is the fact that oil is more expensive to hedge than is natural gas. This is especially true for hedges realized three or more years out. Most upstream MLPs hedge a clear majority of their production out at least four years. More conservative hedgers, for example Linn Energy, have nearly all production for the next four years hedged, and a majority of production in the fifth year hedged as well. Mid-Con, by contrast, has hedged 76.3% of this year's production, 70.3% of next year's production, but only 5.4% of 2015's production. Compared to other upstream MLPs, Mid-Con is thinly hedged.

Distribution Coverage

Before chalking up Mid-Con as "too risky" because of its relatively short-term hedging policy, consider the partnership's substantial coverage. Based on this years guidance (which Mid-Con is more or less on course to meet), the partnership can cover its distributions by 1.3 times. This is the highest coverage ratio among upstream MLPs.

So, while Mid-Con's hedging policy is less comprehensive than that of its peers, both the partnership's cash flow margins and its cushy coverage ratio give this distribution a substantial margin of safety. Given current levels of production, maintenance capex and interest expense, Mid-Con will be able to pay its distributions with a realized oil price as low as $73. That's a fairly safe bet.

This quarter's coverage was 1.19 times. We will get more detail on next year's coverage when management releases guidance early next year.

Debt Analysis

Mid-Con's debt sits at a relatively low 1.88 times EBITDA. Much of the partnership's debt is in the form of a revolving credit facility of about $130 million. Of that, $78 million is outstanding and $52 million is available. As mentioned above, we should expect that figure to change when Mid-Con announces the acquisition it is working on.

Right now, the rate on that revolving credit line is fairly low. As with most revolving credit lines, the interest rate is variable. The interest rate is the higher of the Royal Bank of Canada's prime rate, the Fed Funds rate +0.5% or the LIBOR +1.0%. This does give Mid-Con exposure to higher rates, although these rates are all set by central banks, which could take out some of the volatility.

Valuation

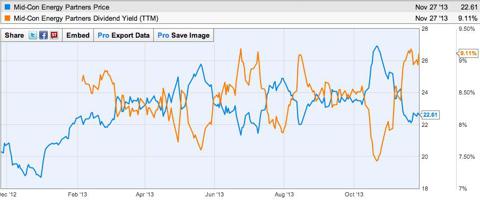

Like most upstream MLPs Mid-Con's value is closely tied to its distribution yield. The above chart shows an inverse, yet very consistent relationship between yield and price. In fact, the two lines are practically mirror images of one another. We can see now that Mid-Con's yield is near a high. This is a good sign to pick up some shares.

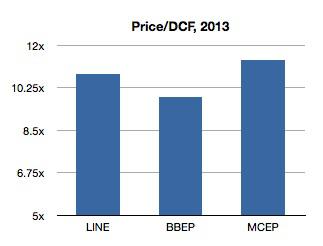

Price to DCF based on 2013 estimates for each respective company.

Here we can see that Mid-Con has come down both absolutely and relatively. In my previous article, written in September, Mid-Con was trading significantly higher than its beaten-down peers. That situation has changed. Mid-Con has since come down a bit while its peers have regained much of what they had lost. Mid-Con and its peers have met somewhere in the middle.

But as long as oil provides returns that are markedly higher than that of natural gas, Mid-Con may deserve to be at a premium to its gassier peers. As we've seen, there are strengths and weaknesses to the business model management has set up. However, a nice yield backed by a cushy coverage ratio make this name a compelling choice right here.

Disclosure: I am long MCEP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: I am long MCEP for a family account.

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1869351-mid-con-energy-partners-yields-9-15-and-is-ripe-for-the-picking?source=feed

Aucun commentaire:

Enregistrer un commentaire