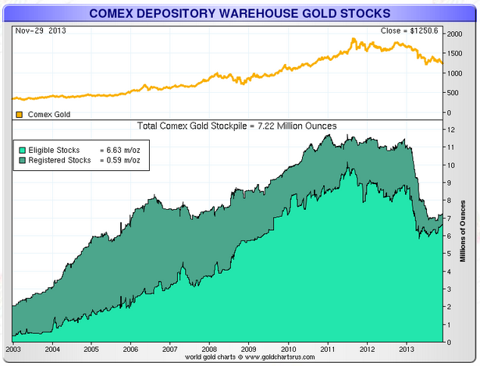

Last week we covered the fact that registered COMEX gold inventories remained near all-time lows as December approached - traditionally the most active delivery month for the COMEX. Additionally, last week we also saw a new high in owners-per-registered-ounce, a measurement used to show how COMEX open interest relates to gold stocks available for delivery.

This week was a relatively slow week in terms of COMEX warehouse activity, and given the Thanksgiving holiday in the United States, this was not much of a surprise. We saw a slight increase in both registered and eligible COMEX gold inventories, and it should be very interesting what happens in December as gold needs to be delivered to meet contract deliveries.

Keeping track of COMEX inventories is something that is recommended for all serious investors who own physical gold and the gold ETFs (GLD, PHYS, and CEF) because any abnormal inventory declines may signify extraordinary events behind the scenes that would ultimately affect the gold price.

Source: ShareLynx

We will take a closer look at these numbers but let us first explain the COMEX a little more for investors who are unfamiliar with it.

Introduction to COMEX Warehousing

COMEX is an exchange that offers metal warehousing and storage options for its clients. The list of their silver warehouses can be found here and their gold warehouses can be found here. In the case of silver and gold, the metal is stored at these official warehouses on behalf of banks and their clients and can be used to settle futures contracts, transferred between clients, or withdrawn from the warehouse. This offers large holders of precious metals a convenient way to store their metal with minimal storage fees - very convenient indeed if you hold large amounts of gold or silver and you don't want to store them in your basement.

Silver and gold stored in these warehouses can fall into two categories: Eligible and Registered.

Eligible metals are those that conform to the exchange's requirements of size (1000 ounce bars for silver and 100 ounce bars for gold), purity, and refined by an exchange approved refiner. Eligible metals are stored at COMEX warehouses on behalf of banks or private parties, but are not available for delivery for a futures contract.

Registered metals are similar to eligible metals except that these metals are also available for delivery to settle a futures contract. COMEX issues a daily report on gold, silver, copper, platinum, and palladium stocks, which lists all the metal that is currently stored in COMEX warehouses and how much eligible and registered metal is present.

This information allows investors insight into how much metal is currently backing COMEX futures contracts, what large gold and silver owners are doing with their metals, and how many clients are requesting delivery of their metals. There is a lot more to glean from this information but for the purpose of this article we will focus on the gold drawdown.

This Week's Changes: Small Increases in both Registered and Eligible Gold

Let us now take a deeper look at the gold draw-downs being seen in the COMEX warehouses.

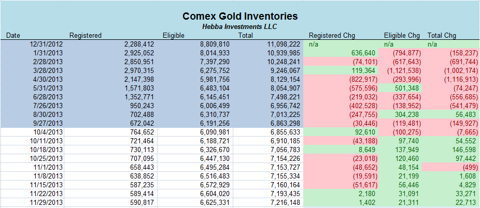

As investors can see, last week saw a small rise in total COMEX gold inventories as 22,713 ounces were added to COMEX warehouses - which makes this the eighth week in a row that gold has been added to COMEX eligible inventories. Registered gold inventories also saw an increase, but it was a tiny 1,402 ounces, which is barely worth mentioning. It is pretty obvious that COMEX gold inventories have stabilized a bit since the heavy declines seen in previous months, but we do note that they remain at historically low levels.

COMEX Gold Open Interest and Registered Gold Owners per Ounce

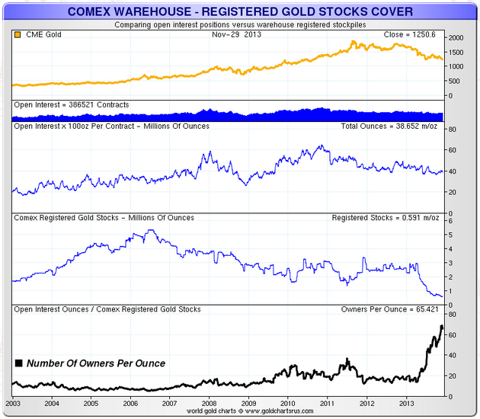

Finally, let us take a look at possibly the most important number when it comes to COMEX gold inventories - the registered gold cover ratio. We've discussed this in-depth in a previous article so please refer to that article for details, but in a nutshell it is the amount of investors owning a claim to each registered gold ounce (i.e. owner per registered gold ounce).

Source: Sharelynx

This week saw a decline in COMEX gold interest as outstanding contract ounces declined from 40.83 million ounces to 38.65 million ounces. But this is hardly surprising as US trading was quite slow for the Thanksgiving holiday and we expect to see an increase again next week as trading picks up. We also note that owners-per-registered-ounce remains extremely high at 65.4, and as the chart above shows, we remain on our parabolic rise in this statistic.

Finally, Indian premiums are again touching highs, and the new Chinese Lunar year approaches. Could major traders be trying to depress the price before December deliveries? We would not be surprised.

What does this Mean for Gold Investors

As we've mentioned in the previous week's article, December has traditionally been the busiest delivery month for the COMEX and this may get quite interesting as registered gold inventories are close to all-time lows and the gold price is at very attractive levels versus its price over the last few years. Geopolitical concerns are quietly rising as Iran remains dedicated to enriching uranium, and perhaps more importantly, China's spat with Japan escalates over China's declaration of an air-defense zone over a set of disputed islands - all things that could lend gold a fear bid.

Even without rising geopolitical concerns, we believe that gold's fundamentals are still very strong and precious metals seems to be one of the few investments that aren't at bubble levels. In our opinion, this is hardly the time to sell and investors should actually be increasing their positions in physical gold and the gold ETFs (SPDR Gold Shares, PHYS, CEF). For investors looking for higher leverage to the gold price, they may want to consider miners such as Goldcorp (GG), Agnico-Eagle (AEM), Newmont (NEM), or even some of the explorers and silver miners such as First Majestic (AG).

With COMEX registered gold inventories near all-time lows and December deliveries approaching, it should get quite interesting at the COMEX as some of these gold contracts come due. Investors should ask themselves what would happen if one of these newly developing geopolitical concerns escalate and investors decide to rush back into gold - where is that gold going to come from without a significant rise in price?

Strong fundamentals, low available physical inventories, and growing geopolitical risks make gold quite attractive at these price levels - investors would be wise to resist the urge to invest with the crowd and instead take a contrarian stance in gold.

Disclosure: I am long SGOL, GG, AG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1869291-weekly-comex-gold-inventories-slow-week-for-activity-but-december-deliveries-approach?source=feed

Aucun commentaire:

Enregistrer un commentaire