Apple (AAPL) has been rumored to be working on a television for quite a while now. Assuming this is true, Apple may be a disruptive player in the television space. Of course, the difficulty with the opportunity is that it isn't easily quantifiable. So with some guess work, Algebra, and Calculus I have done my best to calculate the total market potential for Apple. To be more specific, I estimated how much revenue and profit Apple may generate from television, and digital television services.

However, the real downside to the analysis is that while it tries to be as specific as possible about the market opportunity. There's likely to be known unknowns, and unknown unknowns. So, when considering the research, try to be as open minded as possible. Until Apple actually releases its television, it will be a great starting point for determining the earnings that Apple may potentially generate from the television space.

When Apple actually releases its television we will have concrete sales data, margins, pricing, and etc. At that point I will be happy to update my sales forecast between the 2015 to 2020 period for Apple's television segment.

Why 2015 or 2016

The electronics sector is in decline. In fact, no one cares about televisions anymore. It's not a priority. People would rather spend the same money on an iPad, iPhone, PlayStation 4, or a Windows 8 computer. There's no way to convince consumers the need to upgrade when each upgrade in screen technology offers less and less utility per year. The television market is expected to decline by 5% by the end of 2013, according to IHS.

Conventional logic would indicate that Apple's entry into the television market could be a terrible idea. After all the microeconomic data is indicative of falling demand. Even so, Apple has a great track record of creating value in certain product niches. The Apple iPod, iPhone, and iPad outmaneuvered whole product ecosystems. Therefore, with Apple coming out ahead in almost every market it competes in. One must question how much more effective Apple could be in the television space.

Quoted from the Steve Jobs Way:

By always keeping close tabs on the cutting edge of technology, Apple teams are ready to pounce when all of the elements to make some particular new product possible become available.

Meanwhile, Steve Jobs was gripped by a sense of the magnitude of the music player market. Even better, the market was appealing because the competition wasn't threatening and looked like a market ripe for dominating with a product that would revolutionize the user experience.

Sometimes most everything looks right for an idea to turn into an active development project, except that there are some technology gaps, one or two crucial items that don't meet the Apple standards. But this time (iPod), the stars were aligned.

Apple isn't making an entry into the television space, because of the gaps in 3D technology. Speculators believe that Apple will release a television going into calendar year 2015 and 2016. Apple's entry into the television market is stunted because the limitations of 3D without glasses.

According to a BGR article:

Still, this kind of technology is creeping closer and closer to your living room. We've seen it in portable devices such as the Nintendo DS and the displays of 3-D cameras, but never yet in a full-size consumer TV.

That's still a year or two off. Vizio doesn't plan to have anything on the market until 2014 at the very earliest. By then, it will be significantly improved: Vizio is already talking about displays with 28 3-D viewing angles.

According to the Steve Jobs Way, the company does not ever release technology for the sake of technology. Often certain hardware and software specifications will have to be met in order for top leadership at Apple to push products into development.

So until, Apple can advance its own television technology to be 3D capable without glasses it's doubtful that Apple will release a television whatsoever. Vizio has a great prototype in the works and it can also switch from both 2D and 3D mode easily. Apple may have to license its display technology from Vizio, or develop better technology in house. In either instance, however, the technology isn't likely to be ready until late 2015, or 2016, which is concurrent with mac rumors.

What to expect from an Apple television

Traditional players in the television space will get dismantled. I will offer a more comprehensive analysis of the television segments of Sony (SNE) and Samsung (GM:SSNLF) in a future article. But to be more specific, Apple plays and plays hard to win. There's no way Samsung or Sony could commit the same resources to support such a huge transition from television screens to integrated computing. This would involve a comprehensive mix of software, content ecosystem, semiconductor, retail distribution, and marketing. Apple is one of the best in the world at all five categories and has proven that it can develop its own in-house semiconductor solutions that are comparable to what Intel and Qualcomm could offer.

The advantage to a 50" to 65" form factor device is that you can do a lot with it. You can include technologies that are not on the market, and on the market to offer a comprehensive mix of services that poor Samsung and Sony could only dream of offering. 4K display technology, paired with 3D without glasses. The latest version of iOS, Core i7 extreme, or a comparable processor developed by Apple in-house, and a camera that could blow the Xbox Kinect outside of the universe.

Let's not forget that you'll probably be able to pair your iPhone to your iTelevision, so you can wirelessly access and control the same exact television using your iPhone. Wait, woops, one more thing, all the data that is stored on your iPhone goes to the Apple cloud, and will be shared with your iTelevision. Plus the Apple application store with over a million apps will give Apple TV buyers plenty of content to consume.

Let's not forget that, in a 50" or 65" form factor device, Apple can really turn up the heat, and throw in some very powerful Bose or Beats Audio speakers that could rattle the living crap out of a living room. When you go big, you can explore greater possibilities in technology. What's nice is that Apple's voice-command technology will be stellar (SIRI). Titles for the PC like World of WarCraft and Battle Field 4 could be ported over to be played on computer-like graphics. And finally, Apple may secure the last winning ingredient. An Apple based television content ecosystem.

Of course, in a larger form factor, the device may also be touch screen capable. Imagine a 55" to 65" Apple display in every classroom and lecture hall. Perhaps, an Apple television device will become so multifaceted it will become the ultimate content creation and consumption device. After all Microsoft now supports Apple's ecosystem with Office 365. Plus Adobe Creative Cloud can be accessed using both iOS and Mac.

Certain form factors offer greater advantages than others. After all, you can't use a television for GPS navigation, and you can't use an iPhone to multi-task. So in a sense, Apple's entry into the television space may be truly revolutionary if Tim Cook has the vision and business skills to execute an effective strategy.

Will Apple create its own television ecosystem?

Apple would have to release a television that would both double as a computer and a typical cable set-top device. However, knowing how disruptive Apple can be to content ecosystems, I believe that Apple is trying to secure a third-party network similar to traditional television. The television network would be vastly superior to Netflix, but vastly more expensive as well and will appeal to Apple brand loyalists. This will be extremely difficult to accomplish. To put this in perspective, Microsoft had to develop technology that made television, gaming, and internet accessible on the Xbox One. Microsoft made software, but it couldn't create a whole separate ecosystem for TV.

Currently, the most successful model for distributing content outside of traditional TV packages is Netflix's (NFLX) strategy of buying content from studios and distributing them on a $7.99/month subscription. Netflix operates at much greater economies of scale than any of its nearest competitors. Plus, Netflix's user interface is vastly superior to a cable set-top box, hence the success of the Netflix platform.

In other words, securing contracts for paid-for content could be Apple's greatest barrier of entry into the television space. Similar to how Apple's iPod/iTunes reshaped the music industry, I can't help but imagine that Apple will try its best to alter the content sharing ecosystem of traditional television. The problem is that traditional broadband comes bundled with a cable subscription. It's really hard to convince consumers of getting bandwidth and cable from two different providers. Then there's completion, I can't imagine DirecTV, Comcast, and Century Link giving away a very profitable business to Apple very easily.

In my humble opinion, Apple will pursue a network television strategy. Apple is not selling a 50" television, when it releases its television. It will sell the most technological advanced computer to date. A lot can be accomplished in the form factor of a 50" to 60" device. Plus it can only help that Apple has been working on its semiconductor technology in order to reduce the cost of middlemen (Intel). Plus, Apple isn't bloated with operating system costs (doesn't pay licensing fees to Microsoft), plus all the other components of a computer are relatively cheap. Memory costs are falling significantly, and licensing NVIDIA's technology into an integrated system on a board wouldn't cost too much. What will cost Apple a lot of money when entering into the television space would be the sheer cost of content.

For Apple to create a content ecosystem that's comparable to paid-for channels, Apple will have to offer something similar to both traditional television and Netflix like web-streaming. Apple may have to price its television package to be more expensive than any of the other packages on the market. The upside is that Apple can make its television programming cross compatible across the iMac, iPad, iPod, and iPhone. This would help to offer added stickiness and would greatly compliment the average Apple user's television viewing experience. After all, those who want to watch television on a computer, tablet, or smart phone would have a perfect solution.

What's nice is that Apple has enough cash on its balance sheet to buy all the content in the television market. In fiscal year 2012, Comcast (CMCSA) spent $20 billion on programming and production costs. Plus it generated $62 billion in revenue from its internet, television, and digital programming packages. Currently, the company reports that it has 22 million video subscribers, with a mix of business subscribers contributing to the company's total video subscriber base. Similar to how demand for consumer electronic has been down, Comcast has reported a decline in the total number of television subscribers from 24.2 million to 22 million between the years of 2008 and 2012.

I can only imagine the reduction in television subscription to be attributed to alternative content ecosystems, like YouTube, Netflix, and Hulu Plus. Also, there's no way to reverse this downward trend, which is why Dish Network was pretty desperate to get into the telecom business by offering a buyout term for Sprint. In other words, the executives at these multimedia conglomerates should be very worried about Apple.

This is because; Apple can easily outlay $20 billion in capital per year to launch its own television service. Apple would recoup the costs with hardware sales within a couple years, plus earn subscription fees, which is something I will try my best to illustrate throughout the course of this article.

I can't help but imagine Apple finding itself a very lucrative niche in offering television services to anyone who owns an Apple device. So in summary the big money is in winning television, and not China.

Television market and Apple's earnings from subscriptions and television

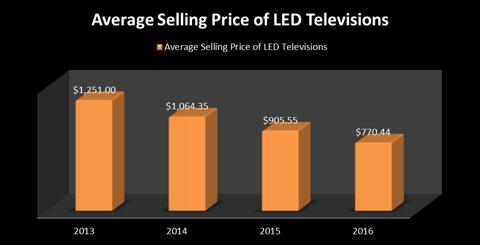

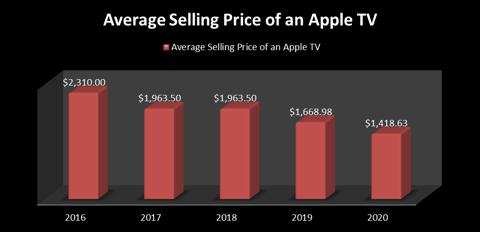

The average selling price of a LED television (Q4 2012) is $1,251. By the time 2016 rolls around, the average price of a television may fall even further. To be more specific, according to the IHS report, the average selling price of a television has declined by 14.92% per year over the past 3-years.

Note: 3-Year regression, at a 15% annual rate, based on historical data.

Over next 3-years, the price of a LED television may regress by 15% per year, based on historical data. So, by the time Apple releases its own television, the average cost of owning a television will be significantly lower. The cost of a smart 3D television by Apple will cost 2 to 4 times as much as the average retail price of a television. Therefore, I expect the average selling price of an Apple television to be approximately $2,310.

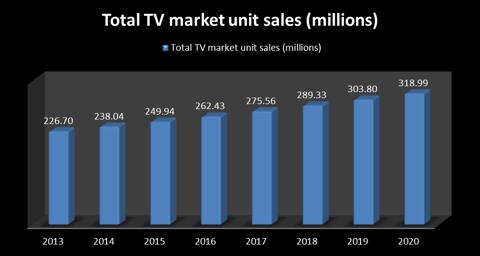

Furthermore, I expect the television market to stabilize, and grow in 2014. I expect 5% compound annual growth rate for total unit sales. The 5% growth rate is based on the LCD/LED growth assumption, from IHS. More specifically, I expect the 15% annual decline in pricing to at least result in a 5% growth rate in annual unit sales, which is a somewhat simplified supply and demand curve relationship. Global unit sales are actually expected to grow at 1% for 2014. But as LCD-LED televisions continue to displace plasma, and CRT TVs it's probable that the growth in the LCD television market will have a larger impact on global unit sales following 2014. The greater mix of LCD-LED televisions will return the market to a normal growth rate above 5%. By 2020, the global TV market may grow to 318.99 million units per year.

Note: Global TV unit sales are in millions. Compound Annual growth of 5% is just an estimate; the actual unit growth may be higher than this as average selling prices of LED television continue to regress at a 15% annual rate.

In 2008, when Apple released its first generation iPhone it sold 11.627 million units. In comparison, total mobile phone sales were 1.22 billion units in 2008, according to Gartner. In the 2008 period, the average price of a dumb phone was approximately $58 per phone. The average selling price of a smart phone was $208. So in other words, the cost and market share of the iPhone will be the starting point for our television forecast.

In 2008, Apple's smartphone business occupied 1% of the total market. Therefore, Apple's market share in television will have a starting point of 1% of total market share. Also, earlier in the article I mentioned that Apple's television will cost 2 to 4 times as much as a dumb LED TV. This is based on Apple's ratio of average selling price of its smartphone to dumb phones back in 2008.

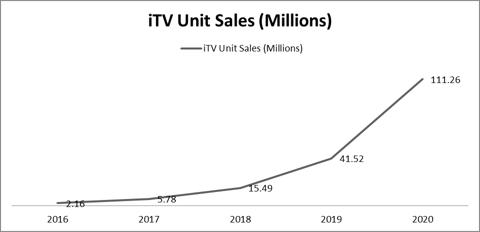

Apple grew the total number of iPhones to 150.257 million units by the end of fiscal year 2013. iPhone sales have grown at a 68% compound annual growth rate since 2008. Therefore, I'm going to assume that Apple's television product will grow at a similar compound annual growth rate. In other words, I calculate that Apple's television will grow at a 68% annual growth rate between the 2016 to 2020 period.

Note: The CAGR in unit sales is 68%. I assume that Apple will occupy 1% market share in the first year.

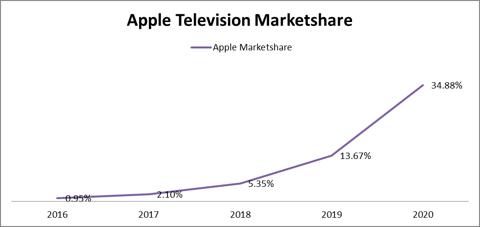

My forecasted growth in Apple's television segment is comparable to third-party estimates of 79.12% CAGR in 3D televisions between 2010 and 2014. According to the same report, the 3D television market will grow to be a $100 billion market by 2014. By comparing unit sales of Apple's television to the television market, I have come up with a basic forecast of Apple's total market share in the space.

Note: Projected market share data is based on Apple's total unit sales in comparison to the projected total television market.

Now that we have come up with a somewhat decent idea on total unit sales, we have to measure the average selling price of an Apple television over time. I don't think Apple can sustain average pricing of 3x the average price of a LED television. So, I'm going to go with a 15% regression for the average selling price of an Apple television. This is because television prices decline by 15% per year on average.

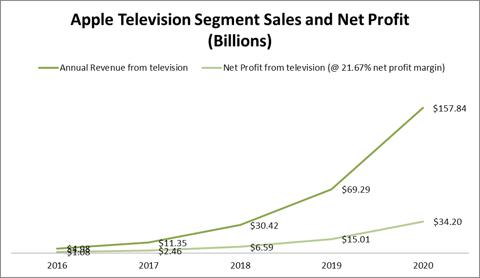

Between 2016 and 2020, I expect Apple TV prices to fall from $2,310 to $1,418. Then to find revenue I will multiply the average price of the Apple television by the annual unit sales. To find the expected profit, I will multiply the segment revenue by .2167. I use the company's current net profit margin to find the net profit from the segment. This is because I expect Apple's management team to retain its current level of profitability once it breaks-even.

By 2020, this segment alone could generate $157 billion in annual revenue, and $34.2 billion in annual profit.

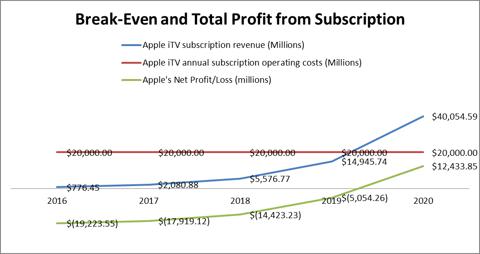

Assuming Apple releases a television subscription package with its TV, and it's probable that the company may earn $30/month for paid-for web-based TV programming. On an annual basis that's $360 in revenue per subscriber. I'm going to assume that Apple will have to pay $20 billion per year to maintain its content network (based on Comcast's content costs).

Note: I assume that Apple will sell a subscription to its TV package every time it sells a television unit.

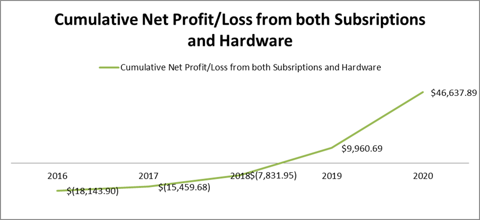

In summary, Apple will not break-even from its content subscription package until 2020. After 2019, the company will have enough subscribers to break-even and earn a profit of $12.4 billion.

However, before it can ever sell a television, the company will have to maintain its own content network at a hefty cost of around $20 billion per year. Therefore, break-even and profitability will not happen until perhaps 2019. In other words, if Apple was to release both a television product and network, it will result in a cumulative loss initially, but generate significant gains towards the end of the forecast period.

(click to enlarge) When combining revenue and costs between the television and digital television programming Apple will generate a profit of $9.96 billion in 2019, and $46 billion in 2020. The up-front cost of creating its own unique content ecosystem is the primary barrier of entry to the market. It would take at least 13.67% global television market share before it can drive enough volume to off-set digital content costs. This is why no one has reinvented television into a fully digital experience quite yet.

When combining revenue and costs between the television and digital television programming Apple will generate a profit of $9.96 billion in 2019, and $46 billion in 2020. The up-front cost of creating its own unique content ecosystem is the primary barrier of entry to the market. It would take at least 13.67% global television market share before it can drive enough volume to off-set digital content costs. This is why no one has reinvented television into a fully digital experience quite yet.

Assuming Apple is able to perfect its 3D 4k TV and is able to offer a fully digital television network, I believe that Apple may potentially earn $200 billion in revenue, and $46 billion in net profit from this segment alone by 2020.

Summary of methodology

If you absolutely believe in my ability to analyze stocks you can happily skip this section, and read the conclusion. However, for those who want a logical explanation as to how I arrived at these numbers, read on.

Over the past 3-years the average price of LED televisions have declined by a decay factor of 15%. I used that same exact decay factor to determine the pricing of the average LED television set.

I start by multiplying the projected average pricing of an LED television by 3 times ($770.44 x 3). This is the starting price of an Apple television set ($2,311). The reason for pricing the television at three times the cost was based on the historical pricing of dumb electronics in relation to smart electronics. We took year 2008 pricing of a phone, and compared it to the pricing of a smartphone. The price of a smart phone was four times that of a normal phone. I took the mid-point of a two to four time price differential. Hence the three time multiple in our present case with televisions (making the forecast more conservative).

Three years into the future, I expect Apple to finally launch its television. I decided that 2016 would be a good entry point. I decided on 2016 because non-glasses 3D television technologies haven't advanced enough. Vizio believes it can create a full 3D experience without glasses over the next 2-3 years.

At the starting point of the projection (2016), I have determined that the average pricing of a LED television will be approximately $770, and when we multiply that by three, the average price of an Apple television is $2,311.

Similar to how the original iPhone had started with 1% global market penetration, I assume the same will also happen with its television device. I also want to add, that by 2016, I project that the television market will grow to 262.4 million units. So by Apple selling to the top 1% of global addressable market, and by selling at a $2,311 price point, I believe that Apple will earn $5 billion revenue in 2016.

I have then determined that from year 2016 onwards we shall assume that Apple's annualized growth will be similar to its iPhone device. This is because, Apple tends to succeed with each new product that it introduces. Therefore, I assume that because the Apple iPhone grew by 68%, the same can be accomplished with its television device.

However, rather than apply a 68% revenue growth rate. I apply that growth rate to television units. This is because each year I expect the price of an Apple television to decline by around 15%. Similar to how others in the television space have to continue to lower selling price, Apple will do the same. However, with Apple, the average price of a television starts at $2,311. By the end of the forecast period, I assume that the average television unit will be sold at $1,418 per unit. The unit sales will be able to outpace the falling price of the television helping Apple to generate both top line and bottom line expansion. In fact, I believe that the falling price will compel consumers to buy a Apple television keeping unit sales growth rates high.

Rather than calculate the individual costs of a television. I decide to assume that Apple will manage its operations so that it will constantly earn a 21.67% net profit margin from each television unit. In other words, I assume that Apple will always earn a profit from its hardware every single year. I also assume that Apple will use any extra cash to further push growth up until it affects the company's cumulative profitability. This means that Apple will always aim to earn more than a 21.67% net profit margin from each unit. By 2020, I expect Apple to sell 111 million units at $1,418 per unit, this result in $157 billion in revenue, and $34.2 billion in profit (21.67% profit margin).

When I combined both the television hardware and television services segment, I assume an upfront loss, then profit later on. The loss comes from content costs. The amount required would put both Amazon Prime and Netflix to shame. This is because I estimate that for Apple to sell subscribers on-demand and live television it would cost in the magnitude of $20 billion per year (this is based on the content costs that Comcast pays). Creating this service would allow anyone who owns a MacBook, iTV, iPhone, iPad to get access to live, local, and on-demand media.

I also assume that Apple will not release this service to other platforms (Windows and Android). Building a stronger moat around the Apple ecosystem will most likely take priority. This will help to keep Apple enthusiasts further committed to buying other form factor devices like the iPad, and iMac. This will further the stickiness of the ecosystem.

As a result I modeled the growth of the Apple television subscription service at the rate at which television units are sold. Granted, some who don't own the Apple television may decide to subscribe to Apple's television service. But on the other hand, we could also assume that some who own the television may not even subscribe to Apple's own television service. As a result, I have decided that subscription growth should be similar to the annualized growth of all its other products (68% compound annual growth rate).

I assume that up-front costs are likely to persist throughout the whole forecast period. Therefore, I assume $20 billion in costs every year, with all the other costs being fairly immaterial and absorbed by the other segments of the business (resources can be shared in an organization). Therefore, I assume that break-even for the division if it sells its subscription at $30/month would not happen until 2020. In other words, when Apple reaches 111 million subscribers for its television service it should be able to break-even. To put this in perspective, it would need 3 times the current subscriber base of Netflix to earn a profit, which would basically require 1/3rd of the US population to subscribe to its on-demand/live-streaming service.

By 2019, I expect the combined results of both the television hardware and television services to generate $9.9 billion profit. I expect profit to grow exponentially in 2020 to $46 billion. This is because I expect by 2020, Apple will continue to scale its subscriber base internationally. Some subscribers may not even own the television but may own a different Apple product. This gives me ample reason to stay optimistic on any attempt that Apple makes at cracking television programming.

Conclusion

Apple is perhaps the only company unto itself to have enough financial incentive and resources to undergo such a huge capital investment phase. Apple's own television network and television product will complete Apple's ecosystem. Plus it may demonstrate Tim Cook's ability to create products without the guidance of Steve Jobs.

Shareholders may want to remain in Apple for the long haul. The Apple television may be an effective solution for computing, entertainment, and work in the living room. Also, if Apple can successfully re-create television into a more digital format it will reap billions of dollars internationally in subscription revenue.

What's most attractive is that hardware and digital networking has significant market potential. This gives Apple enough room to scale revenue and profit significantly. The earnings growth from a TV product launch should have enough of a material impact to shareholders to merit the stock a much higher valuation.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1869431-apple-may-earn-46-billion-in-annual-profit-from-tv-by-2020?source=feed

Aucun commentaire:

Enregistrer un commentaire