Posco (PKX) must be one of the most attractive investment opportunities I've come across recently. Not only is it a profitable company with an excellent track record, It's also one of the best managed companies I've ever seen, priced as a bargain. Warren Buffett himself would be delighted if he'd find such a company. In fact, he already did. In 2006 he decided to take a 5,1% stake in Posco (for a total of $768 million).

During this article I'll try to make you warm for Posco's excellent business and the outstanding investment opportunity that comes along with it. In my opinion this is a serious buy and hold stock that could deliver more than average returns in the medium to long-term.

I'll start by giving a short introduction about Posco and then show you in two different ways why the stock has serious upside potential.

About Posco

Posco (formerly Pohang Iron and Steel Company) is a multinational steel-making company headquartered in Pohang, South Korea. It had an output of 39,7 million tonnes of crude steel in 2012, making it the world's fifth-largest steelmaker by this measure. To see the full list of the worlds' top steel producers, click here. The company is widely known for having/developing superior technology and operating with exceptional efficiency.

Posco employs four major steel producing technologies:

- Finex: This method produces molten iron directly from fine iron ore and coking coal. It is cheaper and results in less harmful emissions than traditional coke-based blast furnaces. Finex was first commercialized by Posco in 2007 at their Pohang facility.

- Strip Casting: This technology produces hot-rolled flat products directly from molten iron by eliminating the slab-making process. This method lowers costs, energy consumption, pollution, and production time. A strip casting plant has been in operation at Pohang Works since 2008.

- Continuous Hot Rolling: Steel slab are produced and then rolled using a solid-state joining method. This process reduces production time and improves quality by making thinner but harder sheets of steel.

- Poscote-C: Flat steel products are coated with high performance resin and speed-dried, resulting in more durable and versatile products. The focus is on developing innovative surfacing technology to create low cost, high grade and environmentally responsible products.

Posco manufactures six major types of steel products:

- Cold-Rolled Steel/Galvanized Steel: used in automotive plates, home appliances, furniture, etc.

- Hot-Rolled Steel: used in pipes, beams, automotive frames/wheels, containers, etc.

- Steel Plates: used in ships, bridges, large structures, shipbuilding plates, etc.

- Wire Rods: used in bridge wire, tire cords, architectural structures, springs, etc.

- Stainless Steel: used in kitchenware, medical devices, buildings, chemical facilities, car parts, etc.

- Electrical Steel Plates: used in current transformers, motors, power generators, etc.

As you might notice, Posco seems to be very cost efficient and uses a lot of high-end technologies in order to stay a head of the competition.

It must be no surprise that Posco still has the highest profit margin among its pears (3% vs. Arcelor Mittal 's (MT) -7.1%, Gerdau SA's (GGB) 2.8% and Nucor Corporation's 2.9% (NUE)).

Posco is known under investors for its delighted management and very experienced executives. Over the years, Posco's management has achieved some remarkable things.

A few highlights of Posco's excellent financial and ethical management:

- In 2012 Posco was relected as South Korea's 'Most Admired' company, before Samsung Electronics (GM:SSNLF) and Hyundai Motor (OTC:GM:HYMLF).

- Posco became the first in the global steel industry to be selected as a global sustainable leading company for 9 consecutive years in the SAM-Dow Jones Sustainability Indices (SAM-DJSI) released on September 12th, firming its position as a leading sustainable management company.

- During 1987 and 2008, Posco returned $4.67 billion of its $25 billion net profit to its shareholders (indicating a 20y annual average pay-out ratio of 18.68%).

- Posco was selected as an excellent company in corporate social responsibility management at the `2013 East Asia 30` Awards hosted by The Hankyoreh on October 31st.

- Posco has maintained a long term debt ratio of only 38% while having $6.16 billion in cash.

- Posco's book value per share went from $33.67 in 2003 to $125.05 today. A 27.13% annual increase.

- Posco's revenue went up 240% during 2003 - 2012 from $17.57 to $59.91 billion. Indicating an annual increase of 26.66%.

- Despite the difficult economic environment, Posco has remained profitable during the past 20 years.

Current valuation of the stock

One can find an outstanding business, but it won't make you wealthy if you can't buy it at an attractive price. Therefore, let's take a look at Posco's valuation.

Posco is currently quoting against:

- A forwarded P/E ratio of 9.11 (following finviz).

- A price/sales ratio of 0.4

- A price/book ratio 0.6

- A price/cash flow ratio of 3.6

At first sight one can think that Posco seems to be cheap. However, I think it would be better to took at Posco's 10 year average of the above mentioned ratios before making a conclusion.

Posco's has been historically quoting against:

- A P/E ratio of 9.73 (vs. 9.11 today)

- A price/sales ratio of 0.81 (vs. 0.4 today)

- A price/book ratio of 1.12 (vs. 0.6 today)

- A price/cash flow ratio of 8.04 (vs. 3.6 today)

Following the results of our comparison, Posco is fairly valued when it comes to a P/E ratio comparison, but is seriously undervalued on all the other metrics.

- P/E ratio undervaluation: 6.37%

- Price/sales ratio undervaluation: 50.61%

- Price/book ratio undervaluation: 46.42%

- Price/cash flow ratio undervaluation: 55,22%

= Average undervaluation: 39.65%

Following the above mentioned facts, a 39,65% higher share price of +- $106.27 would be justified. It would bring the company's valuation ratios more to its 10 year average.

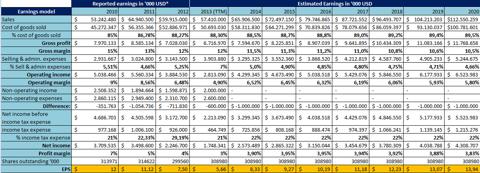

Earnings model

Looking at historical valuation ratios is one way of making an estimation of what the current valuation of the company should be like. Making an estimated forecast of future earnings is another. I'd like to combine both.

In Posco's annual report of 2010 stood that the company wanted to reach a revenue number of 200 trillion KRW (or $188.4 billion) by 2020. As I believe that number was a little too ambitious, I have chosen for a more conservative earnings model which foresees $112.5 billion in revenue by 2020.

For my earnings model I've used following assumptions:

- 10% revenue growth during the first 5 years (2014-2018).

Then a revenue growth of 8% (2018-2020). - % Cost of goods sold will increase year over year by 0.2% (so a declining gross margin).

- Selling and Administrative expensive will decrease y-o-y with 1% (cost management).

- There will be an annual non-operating loss of $1 million (this could be less or more, this depends heavily on the company's private investments, but I thought it would be more conservative to in calculate a loss than a profit).

- Income tax rate will be around 22% (close to its historical tax rate).

These assumptions are not exact but I believe they can give the investor a reasonably example of what future earnings might look like. If the investors prefers even more conservative numbers, he or she can always make an adjusted earnings model.

Following my model, Posco should report EPS of +-$13.94 by 2020. Indicating a $135.63 share price or an upside potential of 78,23% (11,17% annually).

| EPS 2020 | 10 Y average P/E ratio | Future share price | Upside potential |

| $13.94 | 9.73 | $135.63 | +78,23% |

Let us now assume that the company will continue to pay out 18% of its net profit to its shareholders in the form of dividends.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | Total |

| $1.50 | $1.67 | $1.84 | $2.01 | $2.20 | $2.35 | $2.51 | $14.08 |

By 2020 you should have collected $14.08/share worth of dividends. Giving you an extra return of 18.50% on top of the 78.23% share price increase.

Conclusion

Following my two methods, Posco has a current undervaluation of 39% and could give you a return of 96.73% within 7 years. I think it is clear that the market is underestimating Posco's strong management and its capability of doing extraordinary things with its resources. Not many companies in the steel-iron industries have been profitable for 20 years straight, especially not during these hard economic circumstances. The recovery of steel and iron prices in future years should increase Posco's profitability and will be the catalyst for its share price. I'm sure that investors who are willing to join Warren Buffett now, will see nice returns in the future.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performances of the companies discussed may not achieve the earnings growth as predicted. The information in this document is believed to be accurate. All the project earnings in this article are not accurate. They are a result of the assumptions used in my personal earnings model. Under no circumstances should a person act upon the information contained within. I do not recommend that anyone act upon any investment information without first making an analysis yourself or without first consulting an investment adviser.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in PKX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868661-i-see-100-upside-for-this-steel-making-company?source=feed

Aucun commentaire:

Enregistrer un commentaire