Screening for potential investments in the financial sector, I entered the following simple criteria:

- Price/Book Value < 3

- Return on Equity > 15%

AmTrust Financial (AFSI) was one of the first results on my list due to the ticker and I decided to take a deeper look. Overall, I was very impressed with what I found.

Overview and Business Model

AmTrust is a $2.6B global property and casualty insurer that sells to underserved, niche customer groups. The business model seems straightforward and compelling:

- Enter niche, neglected insurance markets with lower than average industry combined ratios and penetration.

- Markets consist mostly of small businesses resulting in a high volume of small policies that the company manages efficiently by streamlining claims handling and other automatable processes via advanced proprietary software.

- Supplement growth with a few acquisitions per annum of small insurers and renewal rights in the range of $50-200mm each.

AmTrust is a company with a strong sense of self-identity that plays to its perceived strengths. The company describes itself as a "software development company that happens to do insurance." The company has a team of 150 IT personnel that develop proprietary software to automate claims handling and other aspects of account management, and constantly analyze and update underwriting risk data.

Source: Amtrust Financial Q3 2013 Investor Presentation

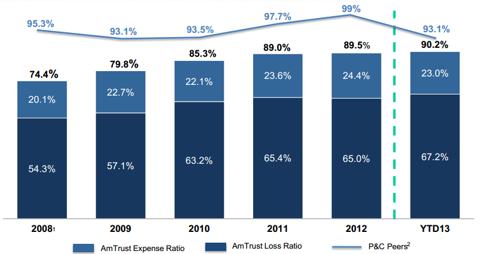

Management claims that this emphasis on information systems enables the company to boast industry-leading expense ratios and, looking at the numbers, I'd have to agree with them. Expense ratio has been stable at about 23% for the last 6 years at least, which is comparable to the likes of Aflac (AFL) and other highly-regarded insurers. Recognizing this unique strength, the company targets niche markets consisting of many small businesses of 8-10 employees and warranty policies on personal electronics, equipment, furniture, and automobiles. Most other insurers target the big money, higher risk policies, bidding down prices and recording underwriting losses while Amtrust expresses no interest in competing on these policies and instead picks up the crumbs that no one else is looking at. Apparently it's a profitable strategy because all the crumbs have added up to $3.8B in gross written premiums in the last 12 months.

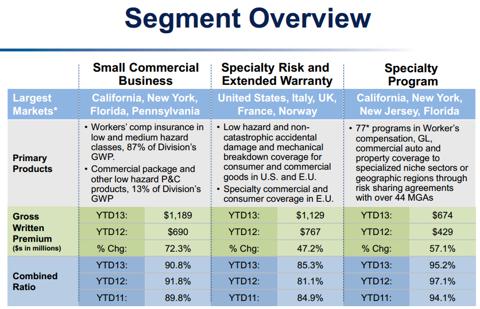

The company consists of three segments:

- Small Commercial Business

- Specialty Risk and Extended Warranty

- Specialty Program

The Specialty Commercial Business and Specialty Risk and Extended Warranty segments are rather self-explanatory and the best way to describe the Specialty Program segment is "everything else" or "miscellaneous". In the Specialty Program segment, the company accepts somewhat higher risks and is much more aggressive. While the underwriting in the other two segments is narrowly-defined and conservative, the company reaches more in Specialty Program and targets various 'super-niches'.

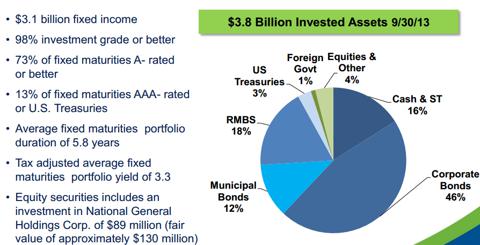

The investment portfolio is solid. It consists mostly of corporate bonds and is 98% investment grade with an average after-tax yield of 3.3%.

The company and all its subsidiaries have A (Excellent) rankings from A.M. Best, the 3rd best of its 16 ratings. The company was also on the 2012 Fortune "100 Fastest Growing Companies" list.

Management

The company was co-founded by the brothers Michael and George Karfunkel and Michael's son-in-law Barry Zyskind in 1998. Barry Zyskind is the current CEO and chair of the executive committee. He was named as #11 on the 2012 Forbes list of "America's 20 Most Powerful CEOs 40 and Under." He received an MBA from NYU Stern. Although Michael is the company's chairman, both he and George are actively involved in other companies, nonprofits, and the New York and Chicago real estate markets. It seems that Barry is running the show and they trust him enough to back off and let him do it.

Barry Zyskind recently received a multi-year RSU package but on an annualized basis when all is said and done he makes about $5mm annually at this point. The executive management team as a whole makes about $15mm. That is very high compared to industry peers. It's somewhat justified by how much more efficient and profitable Zyskind and his team have AmTrust than the rest of property casualty (ROE is consistently around 20% vs. a 5.49% industry average and AmTrust sports a consistently lower combined ratio), but I still think it's excessive and governance is one of my biggest concerns here. Zyskind is a co-founder giving him a little bit of that 'untouchable' status. Although he isn't the chairman, he is chair of the executive committee, and he'd have to mess up pretty bad for Michael Karfunkel, his step-dad, to check him.

As I started to listen to the Q3 earnings call, I got very concerned. Zyskind had only 389 words worth of prepared remarks and sounded very unenthusiastic and mechanical. It may not be material to other investors, but I like a CEO who sounds sincere and genuinely interested and involved in the business. Zyskind made up for it the Q&A though. He gave thorough answers and demonstrated a sophisticated understanding of the business. I was particularly impressed by the following:

"And I think, we look at it, we are big shareholders and every day we wake up, we want to build book value growth. We want to grow earnings per share and the way to do is to do it in what we believe is the most optimal structures. So, equity -- common equity is the last thing you want to issue, but you want to continue growing the business and raising capital in the way that's the most efficient to the shareholders."

This quote brings in two important topics that I want to address, but more importantly, this is exactly what I, and any other prospective investor wants to here. This quote tells me that the value-based management (VBM) that I so desire exists at Amtrust. They seem to care about creating value and have demonstrated an ability to do just that. It's particularly important that value creation is the basis for decision making for a company that regularly engages in acquisitions, an activity that can easily be value-destructive if done impatiently and carelessly.

The other topics this brings in are a) management's stake in the business and b) stock issuance and repurchases.

Zyskind mentioned that they are 'big shareholders' but to quantify that:

- George Karfunkel owns $25mm in 6.75% preferred shares and $350mm of common

- Zyskind owns $270mm of common

- Michael Karfunkel owns $42mm of common

- Collectively, they own about 21.3% of the company and that's not including Ron Pipoly and the rest of the executive management team.

Other than George's recent purchase of preferreds along with CFO Ron Pipoly, no one has voluntarily bought shares in the last 12 months. On top of that, in August the company offered a 10% stock dividend when the stock was substantially cheaper than it is today. Obviously the stock dividend doesn't affect the business in any way - and it doesn't change the company's cash position at all - but I worry that maybe it's a signal that management thinks the stock is expensive.

Health of the Business

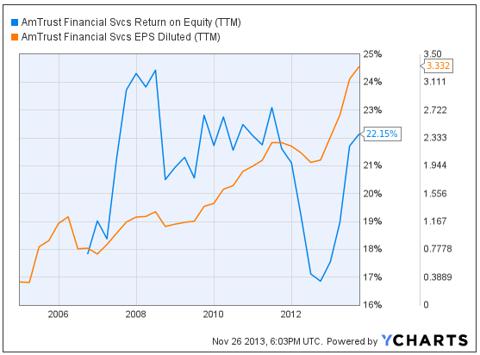

AmTrust has been a remarkably strong and consistent performer in the past and the story is still very much intact. ROE, the main value driver in financial services, has consistently been around 20% in the past seven years and has been trending strongly of late. EPS has grown steadily and has also been trending well lately. CEO Barry Zyskind said in the Q3 call that the company expected to continue to perform as well if not better than it has in the past, due to an improving pricing environment, a less competitive acquisition landscape, and continued success from the company's basic formula for success.

Overall, combined ratio has steadily increased in recent years, likely due to a combination of competition bidding down prices, but also more aggressive policy acquisition. The company also suffers from one-time negative contributions from time to time when it acquires another company or book of business of lower quality than the company's. The company anticipates being able to tighten up the underwriting on these acquired policies but it still hurts metrics temporarily.

Up until 2013, the gap between the company's combined ratio and that of P&C peers narrowed substantially, but both moved upward so some of the increases in the company's combined ratio can be attributed to a weakening pricing environment. The recent trend is more concerning though. Even as P&C peers got their combined ratio down nearly 6%, Amtrust couldn't follow suit and actually showed a slightly worse number. Either the company's competitive advantage is diminishing, or the company is offering lower rates in terms of loss ratio than its peers voluntarily to draw in more business. I suspect it's a combination of the two, but it's very difficult to determine without seeing the makeup of peers' combined ratio.

In Q3, the company reported improving retention on voluntary policies, but that was sort of dismissed by management as a one-time outlier and they thought retention would be consistent with 2012 going forward.

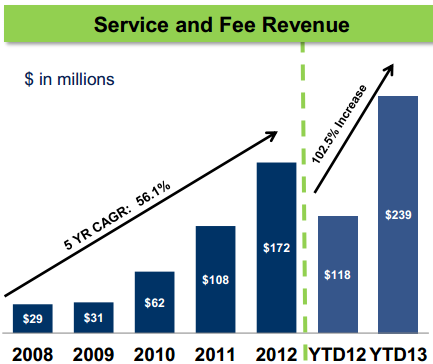

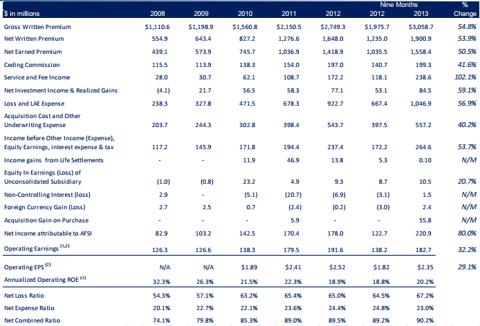

One very bright spot of late has been Service and Fee Income. The company is able to leverage its information systems capabilities and insurance expertise to generate high margin, low risk income that has become increasingly important in the bottom line.

This is the company's fastest growing income source and its success is a testament to the company's information-processing software and expertise. Much of this income comes from a few companies that Amtrust has very close relationships with.

In Q3, the company wrote over $1B in gross premium for the second consecutive quarter, and expects to continue to do so.

Overall, there are very few blemishes in Amtrust's performance and the company continues to perform strongly. Very impressive stuff.

Sentiment

Right now, 9mm shares, or 29% of float, are short. Days to cover is at 18, making a short squeeze very possible. The high short interest can be partly explained by the big insider stake. These insider-held shares aren't being traded, so float is significantly lower than shares outstanding. Shorts may also be targeting the stock because of the deterioration of combined ratio and the fact that the stock is at an all-time-high.

Institutional ownership is only at 52.6% but 8 analysts cover the company, so it's difficult to say whether the stock is going under the radar or not. Analyst consensus rating is 1.9/buy right now.

Valuation

Valuing a company like AmTrust by simplistic multiple analysis is ineffective because the company's ROE, which is far better than industry average, means the stock deserve to trade much higher than book value and at a higher P/B than competitors' stocks.

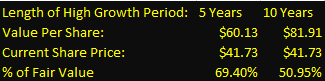

Instead, to value the company I used a basic dividend discount model. Aswath Damadoran, a professor at NYU Stern (where Zyskind went for his MBA) and one of the most respected valuation experts in the modern financial landscape, created the model I used. It can be found on his site by the name divginzu.xls. In my model, I assumed normalized ROE of 19.3% deteriorating gradually to 13% in the terminal phase, an equity risk premium of 5.5%, a high-growth phase of either 5 or 10 years, and a terminal growth rate of 2%. The company's beta is unusually low at .68 which would make cost of equity unusually low and the valuation aggressive, so I instead input the property and casualty industry average of .90. I think most of the assumptions are reasonable and conservative. The only big area of uncertainty is how long the company can maintain its current and historic ROE of 20%. I input for both 5 and 10 years but if I had to guess I'd say somewhere between the two is most accurate. AmTrust is still a small company with room for growth and markets to enter, but then again I don't know how many niche, highly-profitable opportunities are left. Below is a summary of the results:

The results suggest the stock could as much as double, but is substantially undervalued even if the high growth only lasts 5 more years.

Confidence

This is my first time researching the company so I am not as familiar with the business as I'd like to be, but my valuation and research tells me that this is a very attractive low risk investment. The company has a track record of high, profitable growth and is staying conservative and sticking to its guns. The fundamentals are extremely consistent so it's very easy to model. My main concerns are the long-term and recent trends of combined ratio, high short interest, the stock being at an all-time-high, excessive executive compensation, and what may prove to be unsound governance, but other than that, I think it's hard not to like the story.

Conclusion

AmTrust is a differentiated property and casualty insurer that offers investors a compelling investment story. The company has performed remarkably well through a major financial crisis and weak pricing and interest rate environments and is expected to continue to perform as well as it has, if not better as the environment improves. I believe the stock could as much as double in the next 1-2 years and now is an attractive time to enter into a long-term position.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in AFSI, AFL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868551-amtrust-financial-potential-double-with-little-downside?source=feed

Aucun commentaire:

Enregistrer un commentaire