Introduction: Is gold washed out?

Early on in this QE3/QE4EVA period, I thought it likely that gold and silver would rise in price, but I was aware that they had outperformed so much the prior decade that they simply might not join in the inflationary party. When they acted badly, I avoided them. Now that they have collapsed-- and I include silver implicitly in general in discussing gold-- here's why I have begun to watch them closely again.

Technicals: There is one technical factor that I look at several times a week. That is the positioning of futures traders in the gold market. We have now seen the same pattern that was seen at the bottom of the gold bear market in 2008 following the Lehman collapse. However, it is even more exaggerated now. This makes sense, because in the fall of 2008, conditions were obviously right for gold. The price was down due to general liquidation, but the zeitgeist suggested that gold looked likely to break through its 1980 high and stay in record territory.

Today, it's different. Sentiment is horrible. It is so bad that commodities uber-bull Jim Rogers is bearish on gold, saying he could see it drop another 20% to $1000. That's a puzzling view, because a couple of years ago, he was bullish on gold at much higher prices. No matter. Except for people in the business and a few bloggers who are not in it for the money, gold is ignored these days. That's a good thing. It allows a normal market. Now that gold is 35%+ off its 2011 high, we see a multi-year record level of bearishness from speculators on the futures exchange. Actually, to be clear, because of the nature of gold trading, what we see is a lack of bullishness by the speculators. Graphically, this is reflected in the FINVIZ chart by the green line at the bottom (offsetting commercial net short position) double bottom in lack of speculator bullishness is similar to and greater than a very similar pattern seen post-Lehman in 2008:

Why should gold be ignored now?

Perhaps because of the very high degree of speculative bullishness on the Nasdaq 100 on the mini contract on the futures market:

Or a multi-year sustained level of bullishness on the Nikkei 225:

Or a huge net short position on the 10-year Treasury note:

This is what one sees when a speculative vehicle from 2011 gets tossed overboard while performance-seekers go elsewhere.

Fundamentals: First I will discuss relative values. Gold at about $1250/ounce is in line with the long-term performance of other financial assets.

Going back to the period of artificial suppression of gold prices at $35 USD per ounce between the early FDR era and August 1971, the "free market" price of gold in Europe was around $40 at that time. The compound annual return of gold from then to now is 8.5%, good but not extraordinary, and very much in line with the increase in the price of oil. Of course, that $40/ounce or so was constrained by the official U.S. price of $35/ounce, so it was not really free.

However, if one goes to the early Volcker era in 1979, starting with a gold price of $400/ounce, the compound annual return has been a mere 3.4%. This is vastly lower than the bond return since then.

Another way to look at things is that gold peaked around $875/ounce in January 1980, with a secondary peak later that year around $700. Now it's only moderately above that level, whereas both bonds and stocks have had moon shots. Furthermore, silver is below its twin peaks of 1980, and is also below its winter 2008 peak, which was over $21/ounce.

Therefore, from a multi-year perspective, gold has been a good but not extraordinary performer. This provides room for the price to rise without getting out of line with long-tern trends in other financial categories.

There are other "fundamental" relationships that gold has had, with the quote marks used because gold trades on currency desks; a currency's fundamentals are in the eye of beholder and can change.

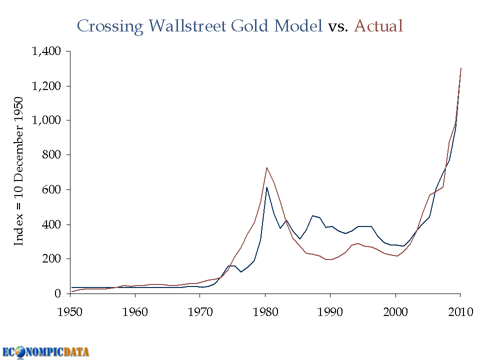

One relationship is the empirical correlation with the inflation-adjusted short-term T-bill rates. There are different varieties of this relationship. The first I saw was created by stock blogger Eddy Elfenbein, with this chart noted in my blog post on the topic (which in turn links to the Elfenbein post). An excerpt:

...gold tends to rise when Fed policy is easy and tends to sink when it is restrictive. His point is that high rates of price increases are not needed to send gold upward. He estimated that a neutral price for gold came when 3-month T-bills were 2 points above the inflation rate (?CPI).

On that post, I showed a long-duration chart adapted from his:

That relationship has broken down. It did not work in the 1980s, either, but the general principles are in my view reasonable (see linked articles for details).

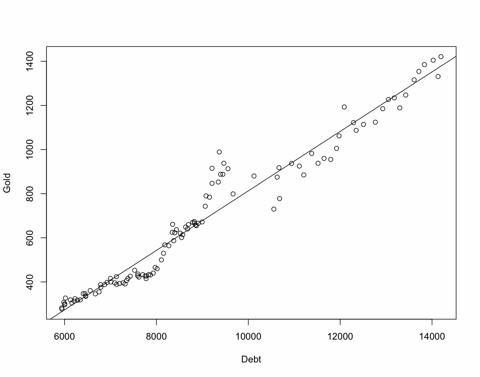

Another relationship involving gold was a chart shown over and over on different gold bug sites. This showed a close correlation with the aggregate Federal deficit and the pride of gold. But obviously the total deficit is much larger than it was at gold's $1900/ounce peak in August 20111, but gold is in a major bear market. With the Fed (i.e. the government) monetizing government debt and mortgage debt rapidly, perhaps this relationship will also revert. Here's a chart on this topic:

That was from 2011, and the price of gold has dropped since then while the total deficit is much larger. Unlike the case in the 1980s and '90s, the Fed is now monetizing much of the debt; this policy change to favor inflation over disinflation should provide a tailwind for the price of gold.

Another longer-term fundamental is that the gold miners are acting more like businesses. They are cutting production to focus on profitability. I think they have learned an important lesson. At least on the margin, this new focus will limit supply.

China: Gold bugs talk incessantly about massive Chinese demand for gold. This is putatively paid for by Western central banks and commercial bullion banks leasing out gold. I do not know how this phenomenon, if real, can be used to project future price changes for gold, but if China grows in wealth and the Chinese people continue to be encouraged by their government to accumulate gold, this would tend to lead to a different outcome than was seen following the 1980 peaks in the gold price.

Relative valuation: I like to look at the platinum/gold ratio. Platinum is much rarer than gold. In the past, gold has not done well relative to platinum unless its price has been a good deal below that of platinum. One of the tipoffs that QE forever was not fated to inflate the price of gold further was that gold was priced equal to or higher than that of platinum per ounce. With platinum weak the past two years and gold's price close to platinum's price, this personal indicator leaves me cold on gold. It's not terrible, but I there's no margin of safety here that suggests fundamental undervaluation of gold relative to a different, non-monetary metal.

Alternative views: One is that in the world of Bitcoin, who needs gold?

Another negative and valid point is that gold has not exited its intermediate-term and short-term downtrends. Thus a number of technical factors are not now propitious.

Another of many valid points is that gold is so well studied, there's little incentive to try to outguess the pros.

Yet another is that when overheated markets such as gold and silver became in 2011 get cold, it's rash to buy in unless the fundamentals and technicals have both had time for healing. It may simply be too soon to take a position in gold.

How to invest in gold: Common "paper" vehicles with which one can gain exposure to gold include the Sprott Physical Gold Trust (PHYS) and the well-known and highly liquid, well-known SPDR Gold Trust (GLD). Of course, physical gold is the "gold standard" of gold investing. It has its own pros and cons, which are not going to be addressed herein.

Additional comments: Many important nations and supranational bodies carry gold on their books as an asset. Thus gold has good sponsorship. With a seemingly unending amount of money being printed in many countries, gold's bear market may be a buying opportunity. This view would treat gold the way stocks are treated: buy the bear, and don't focus on picking the precise bottom.

Contrarian analysis of the futures market and in popular opinion, at least in the U.S., suggests that at least a short-term rebound in the price of gold could be in the offing.

However, new, meaningful, reaction lows for the price of gold would strike me as invalidating this investment strategy. Since this could occur via a crash, there is no guarantee that putting in an actual or mental sell order if the midyear lows were undercut could actually be realized, even though such a strategy sounds good in theory.

Summary: Sentiment on gold is bearish; even Jim Rogers is a tactical bear. Relationships that sustained and were bullish for gold in its decade-long bull market have broken down. When they broke down in the early to mid-'80s, gold had cyclical rallies within a two-decade bear market. Multiple metals such as platinum and copper are weak; nothing special points to gold as exciting for new money.

Overall, my sense is that it is probably too late for investors who do not need the money to sell their gold, but the current downtrend is too powerful for most investors to commit serious money into gold right now. Traders, however, may wish to go long gold on selloffs which are accompanied by predictions of doom for this asset.

My long-term bias is that governments are seriously interested in inflation, and that gold is a solid asset for patient holders. Investors of that mindset who do not own gold may consider purchasing some now, given the impossibility of timing this or other markets.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: Not investment advice. I am not an investment adviser.

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1869321-is-gold-hated-enough-for-new-money-investment?source=feed

Aucun commentaire:

Enregistrer un commentaire