Actuate Corporation (BIRT) is one of those companies that breaks down 'big data' into digestible information. And there is a lot of big data that businesses need to analyze and understand. Actuate does have some execution risk related to making a transition in its business model; however, investors might be placing too much emphasis on Actuate's legacy issues, and not enough on its high-growth future. 2014 is expected to be an inflection point, with the company potentially posting record sales for the year and seeing a turnaround in margins.

What Actuate brings to the table

Actuate is a software and service provider for business intelligence applications. Actuate derives revenue from two key lines, one is license fees (for using its software products) and fees for services. More specifically, Actuate offers services for deploying business intelligence based custom and information applications for browsers and mobile devices that deliver content in the cloud, SaaS and on premise. They cover various business functions including financial management, sales management and account management.

Its key product is BIRT iHub, which integrates and manages BIRT-based information and analytic applications. This platform is highly scalable and delivers interactive, actionable business information to employees, customers and partners. BIRT iHub can integrate information from any data source and application, and can be phased in, adding features and resources as required.

Actuate snatched up Quiterian in late 2012. This move gives Actuate an even stronger set of algorithms for data discovery. The move reduces the company's dashboard and reporting limitations by offering the ability to dig deeper into the analysis category of business intelligence and analytics.

Thanks to this addition, it should only further its addressable market and potential customer base. Its customers vary across a number of industries and include many top Fortune 500 companies. These include financial services, government, high technology, healthcare, manufacturing, pharmaceuticals, telecommunications, utilities, automotive, education, entertainment, travel, and retail companies. During the third quarter alone the company had transactions with the likes of UBS, MetLife, and fiserv.

Offering best in class services

Gartner's 2013 Magic Quadrant for the Business Intelligence space outlines some of the key strengths for Actuate. The most notable is that back in 2012 the company posted double digit growth in its BIRT product lines. That's a big positive for a company that's relying on its BIRT products to offset continued losses from the legacy business.

Beyond that, Gartner notes that "Actuate continues to deepen and broaden its BI application development platform, ActuateOne, to include the support and storage of unstructured data sources, including high-volume print output and PDF archives via X2BIRT, the support of big data insight on touch devices, and additional scorecard and collaboration options for dashboards in BIRT 360."

What keeps bringing customers to Actuate is that its products are easy to use for developers, and it supports a very large number of concurrent users. But it's performance is one of the biggest draws for customers. Gartner notes that...

"...when references were asked what percentage of employees were users, Actuate references averaged 68.62%, which is significantly higher than the industry average of 30.1%. For performance only, 4.44% of Actuate references indicated that performance was an issue, compared with the industry average of 11.5%. When asked about the most important reasons for buying the software, 28.89% of Actuate references said performance, compared with the industry average of 16.5%.

Trustradius.com latest review is very positive for Acutate, with a couple of keys being that (emphasis ours)...

- "Actuate has permitted us to create stronger visualizations of data and customer data for our clients so they can make better decisions about the course of their businesses.

- Birt Analytics integrates with Salesforce.com , Microsoft Dynamics, Xcel in a short period of time and permits stronger massaging of data and integration with better "what if"scenarios.

- The ROI on this product is remarkable.

- Employees who visualize the data and other components who have been questioning the direction of management change their focus upon what they can do to improve the company. Managers who are "micromanagers of data" actually begin to visualize where some of the sub-strata they have wasted time is impairing company results.

- Customer support for their products is excellent. If you need support on site they are there when you need them."

On g2crowd, ActuateOne has a 4.5 star rating. One of the latest reviews further sings Actuate's praises.

"What do you like best? ActuateOne is a complete business intelligence platform that can easily be customized to meet your every BI/Reporting/Dashboarding/Analysis needs. The APIs can automate any task you desire and can seamlessly integrate ActuateOne into any environment or application you desire. It is easy to learn, easy to use and is platform and database independent."

On the flip side, Gartner outlines its largest concern for the company. Which is, that licensing costs are high, noting that "when references were asked what limits wider deployment, 37.78% indicated the cost of the software, compared with the industry average of 25.4% across all vendor references."

All in all, it appears that Actuate's products are some of the best in the business, but it's a matter of pricing that's keeping some companies from adopting the software. However, the key is understanding the benefits, the greater "bang for your buck" that Actuate offers. This involves increasing the number of salespeople touting Actuate's services (more on this later).

Third quarter showed continued weakness, but hope on the horizon

The BI company announced a $40 million (over 10% of shares out) buyback program at the end of 3Q, to be fulfilled over the next year. During 3Q, the company bought up $6.2 million in shares, with that number expected to jump to $10 million during 4Q. Drilling a bit further into 3Q, license revenue was up 8% year over year, and up 18% excluding its Oracle settlement. This comes as the company closed two $1 million iHub license deals during the quarter.

Actuate brought in revenues from North America that accounted for roughly 80% of revenues. The other 20% comes from international markets. Its largest market, North America, saw revenue growth of 2% year over year during 3Q, while EMEA grew 6%.

The legacy overhang

One of the biggest overhangs for the stock, and what's keeping its multiples below peers and the industry, is that its legacy segment continues to be in secular decline. Yet, that's well known. As noted on the latest earnings call, "the reality is, and we've always said this, that the legacy part of our business will go to zero over some period of time. We experienced a bunch of lumpiness associated with the maintenance over the last couple of years, and it's just a matter of time when we experience the same amounts of lumpiness associated with the license portion of that business. And so I think it's a multi-variable phenomenon. It's inevitable that it will continue to decline."

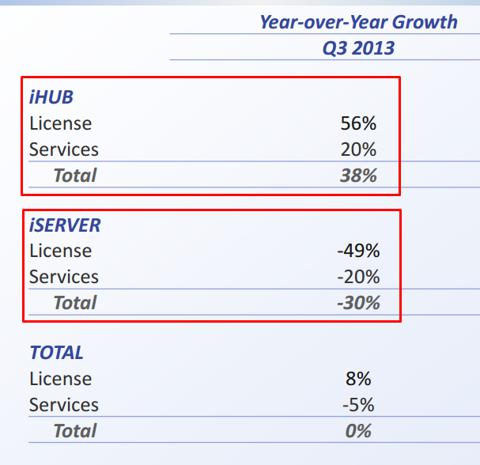

This radiated through in its latest quarter. The legacy iServer (a report server) business saw revenue growth decline by 30% year over year, but its new growth area, iHub, grew 38%.

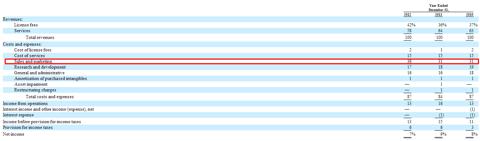

As a result in a decline of its legacy side of the business, for the past five years (ending 2012), revenue declined at an annualized rate of 0.26%, while operating income grew at a mere 2.8% CAGR over the same period.

Behold the future: iHub and a large market

Actuate is looking to hedge a decline in its legacy iServer business with growth from its BIRT iHub license business. Thus, investors should remember that they are buying Actuate for BIRT iHUB and its future potential. In essence, the company is already acting as if the transition from iServer to iHub has already concluded, and they are now solely focusing on the future, which is a big positive.

As far as its markets, the biggest is the three million BIRT developers that it can target. These developers are looking to build customer-facing applications and OEM applications. These developers are looking for seamless integration with enterprise applications. Its other market is big data analytics, which is for business users. These users are looking for visual data mining software that can predict customer behavior for rapidly analyzing real-time and near real-time big data.

A rising sales force brings down margins, but it's a long-term sales driver

The problem for Actuate is twofold, the company is having to ramp up sales and marketing in an effort to generate more awareness for its new products, and ultimately reduce reliance on legacy products. Yet, what this has done is put a big squeeze on margins. Sales and marketing has gone from 31% of revenues in 2011 to 36% in 2012.

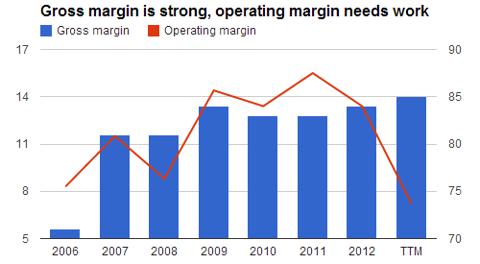

Thus, although gross margins have climbed to near decade highs over the TTM, the company's operating margin is near decade lows.

During 2012, salaries and commissions jumped $4.6 million on the back of a 16% headcount jump in sales employees. A number of notable items driving higher expenses were corporate sales kickoff, marketing and sales presentations, and BIRT road shows. Part of what will help with this is a rebounding economy. As the operating environment strengthens, small and medium businesses should begin loosening their purse strings.

The price is very appealing

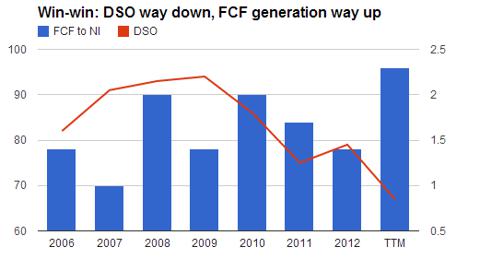

The company has negligible debt, and it has some $1.50 per share in cash, or just under 20% of its market cap. They are now collecting their cash quicker, and doing a much better job at converting net income into cash flow.

EPS for 2014 is expected to come in at decade highs of 40 cents. That puts its forward P/E at a fairly low 20x. What's more is that Actuate trades at 2.2x EV/sales multiple, which is cheap by almost any standards, but especially in the internet space. Compare that 2.2x to some of its notable comps, Splunk, which trades at over 7x and Tableau at 18x.

Sales are also expected to come in at decade highs for 2014. That puts Actuate's forward EV/sales at 2x, however, based on the company's future growth potential, solid product positioning and stellar balance sheet, it appears a 4x (in the least) multiple is easily justified.

With the help of solid sales growth and multiple expansion, we believe the stock could almost double to $14 in just over a year's time.

Bottom line

There's a lot of talk about 'big data,' despite the fact that there are many people who don't know exactly what that means. Big data is essentially large, unsorted, data sets. Putting that data into an understandable and meaningful format is what Actuate does. This is a very large market, where using data to make decisions based on day to day operations and high-level strategy is something that's very useful to businesses. Actuate's products are first-in-class and we see nearly 100% upside for shares of Actuate.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868631-painting-investors-an-accurate-picture-of-actuate?source=feed

Aucun commentaire:

Enregistrer un commentaire