By Kenny Fisher

The Australian dollar has reversed its recent slide and is pointed upwards in Thursday trading. AUD/USD has moved back above the 0.91 line in Thursday trading. The Aussie got a boost as Australian Private Capital Expenditure posted a sharp gain in October. HIA New Home Sales posted a sharp decline, falling to a three-month low. US markets were closed on Thursday for the Thanksgiving holiday.

The Aussie has finally turned the tables against the US dollar and posted gains on Thursday. The currency has plunged over three cents in little over a week, as it struggles to stay above the 0.91 line. There was good news as Private Capital Expenditure gained 3.1%, crushing the estimate of -1.1%. The business spending indicator has now posted back-to-back sharp gains. The news was not as positive from the housing sector, as HIA New Home Sales declined 3.8%, compared to a gain of 6.4% a month earlier.

In the US, employment numbers continue to look good. For a second straight week, Unemployment Claims came in lower than market expectations. With increasing speculation about a QE taper, employment releases will remain under the market microscope. If employment numbers continue to improve, we can expect the Fed to scale down QE early in 2014, which would likely give a big boost to the US dollar.

The RBA continues to try and "talk down" the Australian dollar, which the Bank says is impeding economic growth due to its high value. Senior officials at the RBA continue to hammer home this message, and did not mince words in last week's minutes, stating that "a lower level of the exchange rate would likely be needed to achieve balanced growth in the economy". The Aussie lost about two cents last week, but this may not be enough for the RBA, which wants to see the currency below the 0.90 level. Clearly, the Bank has been reluctant to take action and reduce interest rates, but the RBA has been dropping broad hints that this could change.

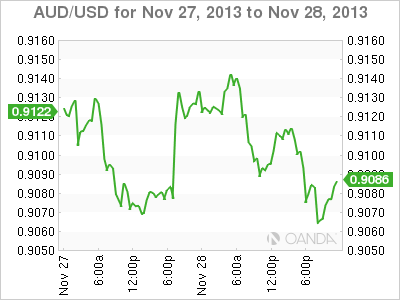

AUD/USD for Thursday, November 28, 2013

AUD/USD November 28 at 12:10 GMT

AUD/USD 0.9126 H: 0.9150 L: 0.9078

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.8893 | 0.9000 | 0.9119 | 0.9229 | 0.9305 | 0.9400 |

- AUD/USD has posted gains in Thursday trading. The pair crossed above the 0.91 line early in the Asian session.

- The pair is receiving support at 0.9119. This is a weak line which could see further activity during the day. This is followed by support at the key 0.90 level.

- AUD/USD is facing resistance at 0.9229. This is followed by a resistance line at 0.9305.

- Current range: 0.9119 to 0.9229

Further levels in both directions:

- Below: 0.9119, 0.9000, 0.8893, 0.8735 and 0.8658

- Above: 0.9200, 0.9305, 0.9400 and 0.9508

OANDA's Open Positions Ratio

After showing no change throughout the week, AUD/USD ratio is pointing to gains in long positions on Thursday. This is reflected in the current movement of the pair, as the Australian dollar has reversed directions and has posted gains. The ratio is made up of a substantial majority of long positions, reflecting a trader bias towards the Australian dollar continuing to move to higher ground.

The pair moved higher on Thursday. With the markets closed in the US for a holiday, we can expect any movement from AUD/USD during the day to be limited in scope.

AUD/USD Fundamentals

- 00:00 Australian HIA New Home Sales. Actual -3.8%.

- 00:30 Australian Private Capital Expenditure. Estimate -1.1%. Actual 3.6%.

*Key releases are highlighted in bold

*All release times are GMT

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868101-aud-usd-aussie-bounces-higher-after-strong-business-investment-data?source=feed

Aucun commentaire:

Enregistrer un commentaire