Spin-offs have been rewarding shareholders over the past 2 years, with many parent companies and spun off stocks both appreciating in value. This has been particularly true with energy-related stocks, such as Murphy Oil, (MUR) and Murphy USA, (MUSA), which both have had nice gains since their spin off in September 2013:

Conoco Phillips' (COP), spinoff of Phillips 66, (PSX) was another big winner for shareholders:

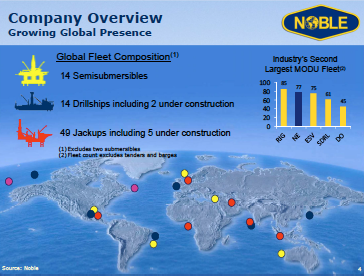

This week's focus stock, Noble Corp., (NE), is in the early stages of its proposed spin-off, which is forecasted to happen in late 2014, pending approvals. Noble was founded in 1921, in Switzerland, but just moved to the UK, a move which may cut its taxes by up to 50%.

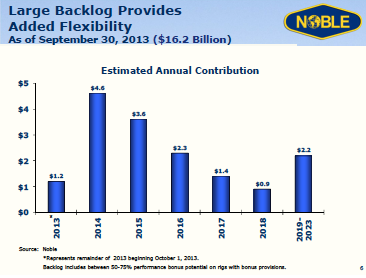

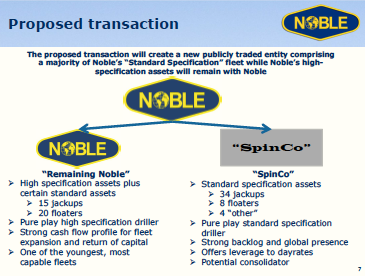

Proposed Spin-off: Noble's website states that "the separation may be preceded by an initial public offering of up to 20% of the shares of the new company. If Noble proceeds with the IPO as part of the spin-off, Noble expects that the new company would file a registration statement for the IPO with the U.S. Securities and Exchange Commission in late 2013 or early 2014. The transaction is also subject to the approval of Noble's shareholders, which the company anticipates seeking in the second quarter of 2014. Noble anticipates that the spin-off would be completed by the end of 2014." The proposed spin-off would leave Noble with highly profitable high specification and deepwater drilling assets, while "Spinco" would receive the standard spec assets which share in NE's big order backlog:

CEO David W. Williams, who will remain as Chairman, President and Chief Executive Officer of Noble, said recently, "The purpose of the separation is for Noble to move forward with our development as a robust high specification and deepwater drilling company through continued execution of newbuilds and fleet enhancements. By separating these two businesses, we believe each company will be able to better leverage the overall value of its fleet by focusing on the drivers of its particular business."

NE's management also believes that this tax-free spinoff would "allow the financial markets and investors to evaluate each company more effectively." (Source: Noble Corp)

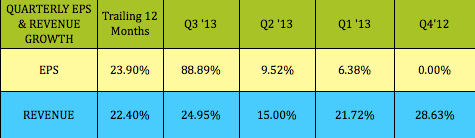

Undervalued Earnings: Noble has been making steady progress on its quarterly EPS, and recently reported blowout numbers for Q3 2013:

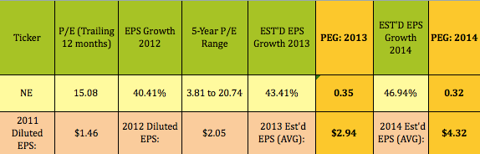

Noble is also forecasted by analysts to have over 40% growth in both 2013 and 2014, and looks very undervalued on a PEG basis:

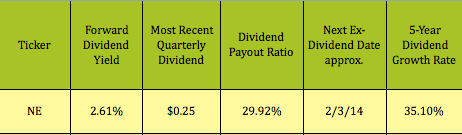

Dividends: Looking for dividend growth? Noble may not be a high dividend stock, like many of the stocks in our articles, but it has major dividend growth - 35% over the past 5 years. Noble nearly doubled its quarterly dividend in 2013, raising it to $.25, from $.13.

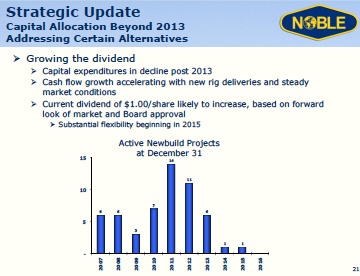

The future also looks good for more dividend increases, as NE winds down its newbuild program in 2014, which should mean more cash available for shareholders. One highlight from this recent investor presentation graphic really caught our eye - "current dividend of $1.00/share likely to increase."

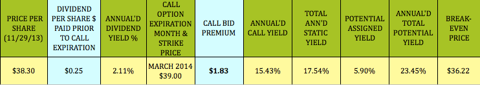

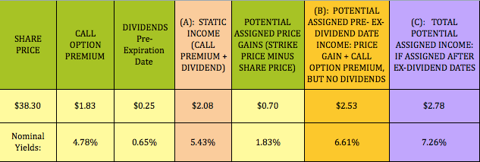

Options: If you want to hedge your bet on NE, this March 2014 trade, from our Covered Calls Table, has a $39.00 strike price, which pays you $1.83, and is $.70 above NE's share price:

The table below details your yields for the main three outcomes on this trade:

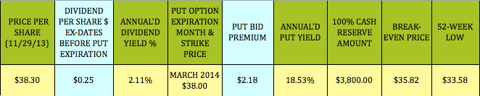

If you're leery of holding NE outright until the spinoff in mid to late 2014, you might consider selling cash secured puts below its price/share. This March 2014 $38.00 put trade pays $2.18, which gives you a breakeven cost of $35.82, around 6% below NE's price/share.

You can see more details for this and over 35 other trades in our Cash Secured Puts Table:

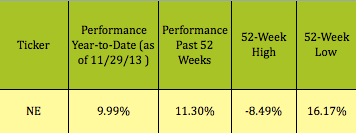

Performance: Noble is trailing the market, which hasn't gotten very excited about NE's earnings and dividend growth, or its spinoff plan, as of yet...

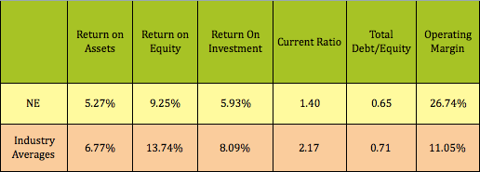

Financials: NE's Management Efficiency and Current ratios aren't as high as industry standards, but they should improve, as it continues to grow its earnings. NE also has a strong Operating Margin:

Disclaimer: Author was short NE put options at the time of this writing.

Disclaimer: This article was written for informational purposes only.

Disclosure: I am long NE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: I'm long Noble, via being short Noble put options.

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1869061-this-undervalued-blue-chip-dividend-stock-spin-off-should-be-a-winner?source=feed

Aucun commentaire:

Enregistrer un commentaire