TJX Companies (TJX) and Urban Outfitters (URBN) both showed impressive sales growth during their respective fiscal third quarters.

TJX Companies Has Years of Store Growth and Earnings Expansion Ahead of It

TJX Companies, one of the largest off-price retailers of apparel and home furnishings in the US, released solid third-quarter results Tuesday. Net sales advanced 9%, while consolidated same-store sales increased 5% on top of 7% growth in the prior-year period. The company's consolidated pre-tax profit margin advanced 0.9 percentage points thanks in part to buying and occupancy leverage and easier year-over-year overhead comparisons.

Adjusted diluted earnings-per-share was solid during the quarter, advancing to $0.75 from $0.62 in the prior-year period (a 21% increase). Fiscal-year-to-date, cash from operations was $1.63 billion and capital expenditures were $759 million, resulting in free cash flow of $874 million, or about 4.5% of net sales. Total cash and short-term investments were $2.26 billion versus $1.27 billion, resulting in a nice net cash position at the end of the fiscal third quarter.

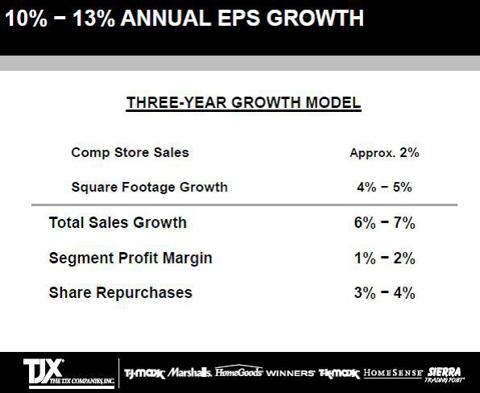

Looking ahead, the company raised its adjusted bottom-line outlook for fiscal 2014 to the range of $2.80-$2.83 per share, a 13%-15% increase from the prior-year adjusted mark of $2.47 per share. We expect TJX to achieve 10%-13% annual earnings per share growth for some time (see image below). Though comparable-store sales may come under some pressure this promotional holiday season, the resiliency of same-store sales expansion gives us confidence in the firm's recently-revised long-term store growth potential of 5,150 units *. TJX Companies expects its store count to reach approximately 3,215 stores by the end of the 2014 fiscal year (ending February 1, 2014), suggesting that there's room for another 2,000+ units in the years ahead.

*The most significant factor in this increase is that TJX believes that its Marmaxx division can ultimately grow to approximately 3,000 stores in the U.S., which is 400 more stores than the high end of its prior estimated range of 2,400 - 2,600 stores. Marmaxx has seen successful growth in both major cities and rural areas over the last several years, which has given the company the confidence to increase its growth estimates. Further, the company believes that its TJX Canada division can grow to approximately 450 stores overall, 20 more stores than the high end of its prior estimated range of 420-430 stores. The company continues to see the potential for HomeGoods to grow to about 825 stores in the U.S. In Europe, the company remains confident in its potential to expand to up to 875 stores overall with T.K. Maxx in the U.K., Ireland, Germany and Poland, and HomeSense in the U.K., before contemplating the opportunity to ultimately expand into other European countries (adapted from press release).

Image Source: TJX Companies

Urban Outfitters Reports Record 3Q; Free People Expanding Rapidly

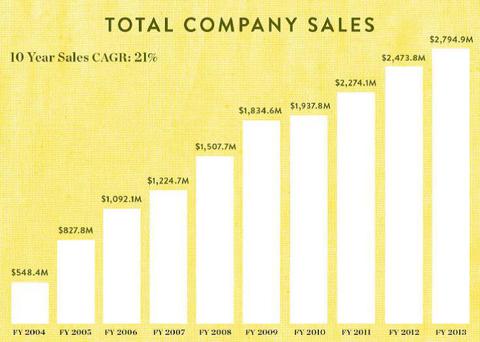

Specialty retailer Urban Outfitters reported record third-quarter results Monday. Total company net sales advanced 12% over the same quarter last year, as comparable retail segment net sales jumped 7%. Leading the charge was strong performance at Free People (1) and Anthropologie (2), where comparable retail segment net sales jumped 30% and 13%, respectively. Same-store sales at its core Urban Outfitters' brand fell 1%, but total company sales continue to perform wonderfully (see image below). The company's gross profit improved 11 basis points versus the prior-year comparable period thanks to a reduction in merchandise markdowns and improved initial merchandise margins at Anthropologie and Free People. Selling, general, and administrative (SG&A) expenses fell 15 basis points compared to the prior-year, helping to drive the profit expansion. Diluted earnings per share totaled $0.47 during the period, up 17.5% from the same period a year ago. The firm ended the quarter with $725.7 million in cash and marketable securities and no long-term debt.

(1) Free People. Its Free People retail stores primarily offer Free People branded merchandise targeted to young contemporary women aged 25 to 30. Free People offers a unique merchandise mix of casual women's apparel, intimates, shoes, accessories and gifts. Free People retail stores average approximately 1,400 square feet of selling space, carry up to 10,000 SKUs and are located in enclosed malls, upscale street locations and specialty retail centers. The retail channels of Free People expose both its wholesale accounts and retail customers to the full Free People product assortment and store environment (adapted from the firm's 10-k).

(2) Anthropologie. Anthropologie tailors its merchandise and inviting store environment to sophisticated and contemporary women aged 28 to 45. Anthropologie's unique and eclectic product assortment includes women's casual apparel and accessories, shoes, home furnishings and a diverse array of gifts and decorative items. The home furnishings range from furniture, rugs, lighting and antiques to table top items, bedding and gifts. Stores average approximately 7,100 square feet of selling space, typically carry an estimated 45,000 to 50,000 SKUs and are located in specialty retail centers, upscale street locations and enclosed malls (adapted from the firm's 10-k).

Image Source: URBN Shareholder Presentation, May 2013

Valuentum's Take

We're expecting a highly promotional 2013 holiday season. From specialty retailers like Best Buy (BBY) to behemoths like Wal-Mart (WMT), pricing competition will be intense as each firm deals with six fewer shopping days between Thanksgiving and Christmas this year. Profit margins will inevitably face some pressure during the calendar fourth quarter (in one way or another). Urban Outfitters is planning inventory accordingly and expects margin pressure, while TJX Companies expects pre-tax margins to be down 30-60 basis points versus the prior-year period. Most of this impact for TJX Companies, however, will be a result of the extra week in last year's quarter. From a fundamental standpoint, TJX Companies and Urban Outfitters continue to execute nicely, but neither firm's shares are inexpensive. We're keeping a close eye on them, however we will not be adding shares to the portfolio of our Best Ideas Newsletter.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868201-tjx-companies-and-urban-outfitters-show-impressive-sales-growth?source=feed

Aucun commentaire:

Enregistrer un commentaire