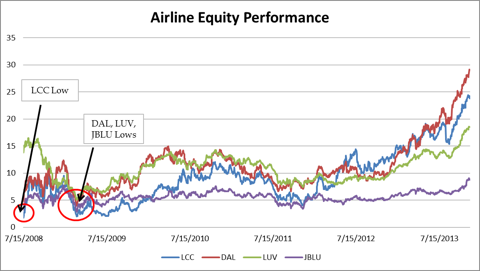

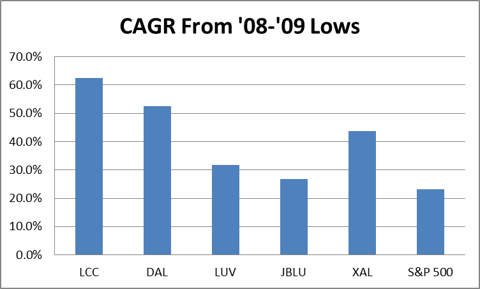

The strong market returns of the past few years, while certainly welcome, have pushed P/E ratios up on equities and have made it more difficult for the value investor to find compelling value-based picks. At first glance, airline stocks wouldn't seem to be a good place to look for value due to the large increase in prices since the bottom of the market during the 2008/2009 market crash. Below is a chart showing historical stock prices since mid-2008, as well as a comparison of annual stock price appreciation:

Although the airlines have performed extremely well as a whole over the past five or so years (a CAGR north of 60% over the past five years for US Airways is simply stunning), I believe that there is still a long way to go for some of these companies to catch up to the rest of the market in regards to PE valuation. Coupling the expected PE expansion with expected increases in revenue and profit, this sector (especially the legacy carriers) looks extremely strong for the foreseeable future.

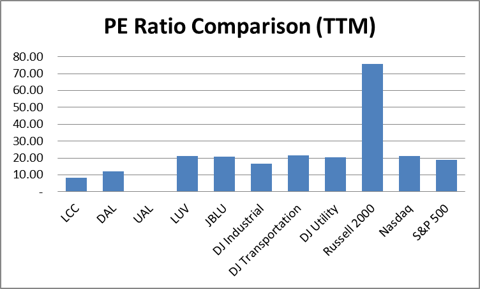

As can be seen, US Airways (LCC) and Delta (DAL) have PE ratios well below industry averages while Southwest (LUV) and JetBlue (JBLU) are right in line with the other industry averages (United (UAL) posted a loss for TTM so their PE isn't calculable). While Southwest and JetBlue will likely see earnings growth, I do not believe that they present as good of an opportunity as US Airways or Delta largely because it is unlikely they will see significant multiple expansion.

The first question to answer is why US Airways and Delta Airlines seem to be discounted by the market. The reason for that, I believe, is still a perception in investors' minds that the airlines are a highly unstable and risky, short-term investment (interestingly, the low-cost carriers, JetBlue, Southwest and Spirit (SAVE) don't seem to have that same prejudice from investors as their PE ratios are all north of 20). A good deal of skepticism is likely appropriate due to the large number of relatively recent bankruptcies, however, I believe that the competitive environment has fundamentally changed - and that change favors the established players in the market. Since that market change hasn't been completely factored into prices, there is an opportunity for the investor to make above market returns.

In looking at the environment the airlines face today, it is striking to note how different things are from a few years ago. In the early to mid-2000's all of the major legacy carriers, except for American (OTCQB:AAMRQ), entered bankruptcy protection, enabling them to cut cost, rationalize fleet types, renegotiate labor agreements and optimize routes. As they emerged from those bankruptcies, the surviving carriers emerged leaner and more efficient. Beginning in 2005, the recent wave of airline consolidations began with the America West-US Airways merger. Following that merger we have seen Delta-Northwest, Southwest-AirTran, United-Continental and most recently, American and US Airways. At the same time, the following airlines ceased operations: ATA, MaxJet, Aloha, Skybus, Eos, Primaris, Arrow and Mexicana. Offsetting this large decrease in competition, the only new entrants have been Virgin America and a separate group of airlines mostly focusing on no frills, at an ultra-low cost. While these carriers (most notably Spirit and Allegiant (ALGT), although Frontier is expected to transition to this model) are growing, they mostly attract a completely different set of passengers than the legacy carriers. Due mainly to the factors above, total domestic seat capacity is down almost 12% from 2005. As the supply of seats has decreased, the airlines pricing power has correspondingly increased.

Another factor that is greatly improving pricing power for the legacy airlines is the weakening of Southwest and JetBlue. Southwest has historically provided the majority of the pricing discipline in the industry by refusing to go along with fare increases and some ancillary fees. However, Southwest now has the highest labor cost in the industry and its cost advantages elsewhere have been dramatically reduced as the legacy airlines have traversed through bankruptcy court. As costs have risen, Southwest no longer has the ability, or desire to keep prices as low as they historically have been and thus are less likely to block future fare increases. JetBlue is in a similar position, although their labor costs are not quite as high. However, JetBlue benefited a great deal from being a new entrant with a new fleet of aircraft. As those aircraft have aged, they have passed through their maintenance holidays and are subject to far more rigorous (and expensive) repairs and inspections. As the so called low-cost carriers costs have increased, the legacy carriers have converged in their pricing strategies, with all of the major airlines separating products and services that traditionally were included in the price of a ticket and charging separately for those products and services. This trend will only continue with Southwest hinting at a change in its "bags fly free" strategy.

As the industry gains in pricing power, it would seem likely that new carriers would be tempted to form to take advantage of the gaps in the market that the low cost carriers are moving away from. However, in my view, it is unlikely that there will be disruptive new entrant carriers - at least not in the near to medium horizon. Fixed costs are extremely high for airlines and a new entrant would need to front the cost for planes, fuel and labor long before being able to generate a dollar in revenue. Compounding the problem are government regulations that add a large additional cost as the new venture attempts to comply with all materials requested - and a good deal of uncertainty as to when an operating certificate may be awarded. Due to the high hurdle needed to start up an airline and the historical bias most investors have against airlines, it is unlikely that there will be new start-ups in the near future. It is possible that foreign airlines could fill some of the demand gap, but there are current restrictions in most countries (including the US) that prevent foreign carriers from serving domestic markets. The US restriction is highly unlikely to be changed due to political forces.

So, the landscape for the airlines, and especially the legacy airlines, looks promising from a competitive standpoint. The unknowns are what the demand environment will be and what the price of oil will be (albeit pretty big unknowns). Assuming the demand environment doesn't collapse and assuming the price of oil doesn't skyrocket this is an industry that still possesses a very high upside, and the best of the group are Delta Airlines and US Airways.

Delta is the best managed company (with the possible exception of US Airways) in the industry. It also has completed its integration with Northwest, which gives it the benefit of not having to worry about merger issues, which seem to inevitably trip up all who go through those events. Net income for the previous 12 months was over $2 Billion and it is expected that they will beat that number next year. I would expect that as Delta, as well as other carriers, post strong numbers that the industry will be given a higher multiple. Although PE multiples are hard to predict, if Delta were to be given the same PE multiple as Southwest (currently at around 21) and even if its profits remained at current levels its stock price (at Southwest's multiple) would be around $51, or an increase of 76%.

US Airways is in a similar situation as Delta, having earned record profits and looking to improve upon that performance in 2014. US Airways PE multiple is only a little over 8 (Delta's is slightly over 12). As the industry and as the company's reputation improve it is not unreasonable to expect an expansion of multiples. Coupled with increases to the bottom line, it is likely that the returns are as good or even greater than what will likely occur with Delta. However, unlike Delta, US Airways is just starting its consolidation with American. Although it is expected that the combined company will be profitable through the merger there is a strong likelihood that there will be bumps in the road that temporarily derail the stock. As it is very difficult to predict with any degree of certainty how the merger will go, I would classify this stock as high reward, but also higher risk, than Delta.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868701-delta-and-us-airways-are-the-best-of-the-bunch-in-a-still-promising-airline-sector?source=feed

Aucun commentaire:

Enregistrer un commentaire