Introduction

In our complete Q2FY13 cost analysis, we went over a number of the industry's all-in costs to mine an ounce of gold in Q2FY13 and discussed one of the most important metrics to analyze the gold industry, the actual cost of mining an ounce of gold, which can help an investor figure out whether it is time to buy GLD and/or the gold miners. In that analysis, we used the Q2FY13 financials to calculate the combined results of publicly traded gold companies and come up with a true all-in industry average cost of production to mine each ounce of gold.

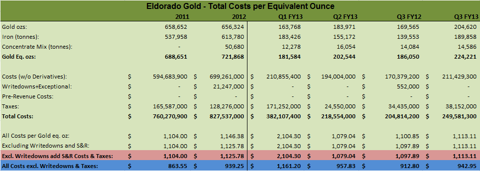

In this analysis we will calculate the true costs of production of Eldorado Gold (EGO), a gold producer that owns operating mines in China, Turkey, and Greece. In addition, EGO owns two base metal mines located in Brazil (an iron-ore mine) and Greece (a base metal mine). EGO also owns a few development projects located in China, Greece, Turkey, and Romania.

How to Use Our All-in Costs Analysis with Your Investments

In the previously mentioned article, we gave a thorough overview of the current way that mining companies report their costs of production and why it is inaccurate and significantly underestimates total costs. Then we presented a more accurate methodology for investors to use to calculate the true costs of mining gold or silver. Please refer to that article for the details explaining this methodology, which is an important concept for all precious metals investors to understand.

The best way to use this analysis for individual companies is to compare the different production cost metrics with the company's profits to look for any anomalies (e.g. large net profits but high costs). Also, we provide historic data to allow investors to check out any trends in regards to costs or production totals that may be an early warning to future successes or failures for the company. Ultimately, this analysis is best used as a first step to further investigative work, and that is our purpose with releasing this series.

Explanation of Our Metrics

For a detailed explanation of the metrics and each metric's strengths and weaknesses please check out our Q2FY13 full quarterly all-in costs gold report where we discuss them in detail.

All Costs per Gold-Equivalent Ounce - These are the total costs incurred for every payable gold-equivalent ounce, which includes everything. This is the broadest measure of costs, and since it includes write-downs, it is essentially the "accounting cost" of producing gold-equivalent ounces.

Costs Per Gold-Equivalent Ounce Excluding Write-downs and S&R -This is the cost to produce each gold-equivalent ounce when subtracting write-downs and smelting and refining costs, but including everything else.

Costs Per Gold-Equivalent Ounce Excluding Write-downs - This is similar to the above-mentioned "Costs per Gold-Equivalent Ounce Excluding Write-downs and S&R" but includes smelting and refining costs. That makes this measure one of the best ways to estimate the true costs to produce each ounce of gold, since it has everything (including taxes) except for write-downs.

Costs per Gold-Equivalent Ounce Excluding Write-downs & Taxes -This measure includes all costs related to gold-equivalent production excluding all write-downs and taxes. Essentially this is the bottom dollar costs of production with an artificial 0% tax rate (obviously unsustainable) which works well because it removes any estimates of taxation due to write-downs or seasonal fluctuations in tax rates, which can be significant. The negative to this particular measure is that since it does not include taxes, it will underestimate the true costs of production.

True Costs of Production for EGO

Let us use this methodology to take a look at the company's results and come up with the true cost figures for each ounce of production. When applying our methodology, we standardized the equivalent ounce conversion to use the average LBMA price for Q3FY13 which results in an iron-to-gold ratio of 17.9:1 iron tonnes to ounces of gold.

Additionally, EGO mines a concentrate mix of lead and zinc at its Stratoni mine in Greece and we converted this mix to gold at a 1.6:1 ratio of tonnes of concentrate to ounces of gold, which was based on the average quarterly price for each sold tonne of concentrate (each tonne sold in Q3FY13 at an average of $820). We like to be precise, but minor changes in these ratios have little impact on the total average price - investors can use whatever ratios they feel most appropriately represent the by-product conversion.

Since our conversions change with metal prices, this may influence the total equivalent ounces produced for past quarters - which will make current-to-past quarter comparisons much more relevant.

Observations for EGO Investors

Eldorado Gold's Q3FY13 true all-in costs (costs excluding write-downs) rose slightly on a year-over-year basis from $1098 in Q3FY12 to $1113 in Q3FY13, but decreased slightly from FY2012 costs of $1126 per gold-equivalent ounce. Much of this decrease in costs seems to be attributable to production increases as gold production jumped to over 200,000 ounces during Q3FY13 - a very large increase in gold production. All in all, EGO has historically been one of the most stable gold miners in terms of its all-in costs, with these costs hovering around $1100 per gold-equivalent ounce.

In terms of EGO's core costs (removing taxes and write-downs), costs have hovered in the mid-$900 dollar range in 2013, with Q3FY13 costs at $943 per gold-equivalent ounce, which was a slight rise of around 3% year-over-year (Q2FY13's costs were $913), but costs dropped sequentially by about 2% from Q2FY13's costs of $958.

Compared to EGO's $1113 gold-equivalent ounce all-in cost; the few other gold companies we've covered in so far in Q3FY13 have reported the following costs: Goldcorp (GG) (costs under $1200), Yamana Gold (AUY) (costs over $1150), Barrick Gold (ABX) (costs above $1350) and Agnico-Eagle (AEM) (costs under $1150). As investors can see, in terms of Q3FY13 costs, Eldorado Gold's costs are lower than many of its competitors and it looks like they had a very strong quarter in terms of all-in costs.

Comparing EGO to the second quarter true all-in costs of other companies they compare as follows: Newmont Gold (NEM) (costs over $1600), Goldfields (GFI) (costs over $1500), Allied Nevada Gold (costs over $1300), Alamos Gold (AGI) (costs under $1250), Kinross Gold (KGC) (costs over $1500), Randgold (GOLD) (costs over $1000), IAMGOLD (IAG) (costs over $1300), and Richmont Gold (RIC) (costs over $1300), and Silvercrest Mines (SVLC) (costs over $1000).

We caution investors to do those comparisons to other companies' second quarter numbers with a grain of salt since these comparisons are for different quarters and use different metal conversion rates.

Conclusion

According to our all-in costs measures, Eldorado Gold registered a very strong quarter with Q3FY13 costs at$1113 per gold-equivalent ounce - which ranks it at the top spot for the gold companies we've analyzed in the third quarter. This is one of the few gold miners whose costs have been very stable over the last few years, so this isn't a surprise but it does allow investors the confidence that EGO can remain profitable at the current gold price.

Of course, true all-in costs are not the only measure of success for the company, and investors should remember that EGO does have operations in a number of riskier jurisdictions such as China, Turkey, and especially Greece - with Greek operations being by far the riskiest. So far management has done a good job of navigating those politically risky jurisdictions and keeping costs low, but it is something for investors to continue to monitor.

Disclosure: I am long GG, GOLD, RIC, AGI, SGOL, SVLC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868461-what-it-really-costs-to-mine-gold-the-eldorado-gold-third-quarter-edition?source=feed

Aucun commentaire:

Enregistrer un commentaire