Twitter (TWTR), the latest internet darling, recently went public; careful to avoid mistakes made by Facebook (FB) the IPO was immediately successful. The shares were initially priced at $23 to $25 per share up from its initial filling at $17 to $20, realizing they were onto a good thing they raised it even further to launch at $26. Since then the shares have traded up to over $50, and at time of writing are trading at $41, with a market cap of $22 Billion - a not insignificant gain of 63% since the IPO.

Heady times

For many, this kind of valuation brings back memories of the tech bubble where companies with no profits trade at stratospheric valuations. In contrast to Facebook Twitter is not making a profit so it becomes much more difficult to see how it deserves that $22 Billion valuation.

Revenue and Users

The following is a breakdown of the usage of Twitter:

Number of users: 500 million

Number of regular users: 200 million

Number of tweets per day: 500 million

Twitter users on mobile: 60% of active users are also active on mobile

In the US there are 53 Million active users, Twitter earns $2.10 per user in advertising revenue up from $1.38 a year ago; at the same time there were 177 million international users generating $0.23 per user over the same period (the recent quarter) - those US users sure are a lot more valuable at 10 times the revenue. From its current user base Twitter should be able to add significant users both in the US and internationally, and it has shown that it can increase per user advertising revenue. Twitter only recently began monetizing its service, it brought in promoted tweets to mobile in March 2012, so it could be argued that it is still optimizing its revenue strategy.

Looking at these numbers there is plenty of room for growth both domestically and internationally. US users are very profitable so Twitter would be wise to make US growth priority number one, with current revenues a US user is equal to 10 international users. While twitter is growing it remains outside the top 15 US mobile properties, at 16% of US users, up from 15% last year, that level of growth is not going to cut it.

Twitter has stated that it intends to ramp up advertising overseas but it also faces strong competitors including Line in Japan, WeChat in China and Kakoa in South Korea.

Cool

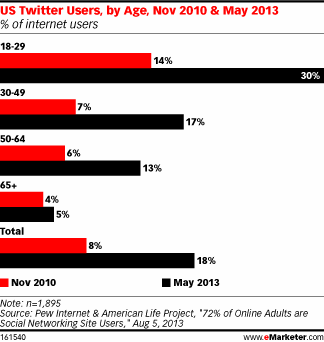

Twitter is undoubtedly cool with the greatest majority of its users in the 18-29 demographic, to see how important this is we only need to look at how Facebook's fantastic earnings report ran aground after it was noted that teenager engagement was dropping, this is in part due to the fact that Twitter was always a mobile company and generally teenagers are more aware of mobile trends than older users. It can also been seen in the following graphic that Twitter has manager to further cement its hold on the much valued younger users, increasing to 30% of its user base.

Stickiness

There are some big questions as to how sticky Twitter usage will become; for long term successful companies they need some kind of moat that will keep users on their service and fends off the competition. Take Facebook, as an example, it has a trove of user data: from status updates, to pictures spanning many years of a user's life that is very hard to replicate.

Twitter's main USP or stickiness if you will, is not from the average user, instead it is the established users that people follow: the Justin Biebers, and Katie Perries. With the most powerful celebrities having in excess of 30 million followers it is a very useful marketing tool with a direct line to their fans. Is this enough to keep up strong user engagement for many years to come? It's is unlikely that these celebrities would jump ship at the drop of a hat, it's not easy to build up 30 million followers overnight but from the average users point of view there is far less reason for them to be loyal, they have very little to lose if they stop using the service, and something newer and shinier comes along.

Due to this fact Twitter faces a challenge in making its service engagement deeper and remaining an essential service for many years to come.

Advertising

Every hot new internet company that comes along appears to follow the same old formula: provide a new service, gather a tone of users, and then chuck some advertising on the site. This is the same model, with varying success, that Google (GOOG), Facebook and now Twitter have implemented. Unless I'm mistaken global advertising budgets are not rapidly increasing, therefore, these companies are all attempting to take a slice of the existing advertising pie, I can only surmise that traditional advertising mediums, print and television, are losing out. With all these hot Internet stocks chasing advertising, this can only become more competitive over time and lead to difficulties in achieving significant revenue through advertising alone. Further pressure will be found from the next hot internet stock chasing the same advertising dollar - Snapchat comes to mind.

Final thoughts

Twitter has had a much more successful IPO than Facebook trading significantly above its IPO price. There appears to be a lot of bearish sentiment in the market around this stock at present with many analysts questioning the valuation, and add to this a lock up period is expiring in February where executives are free to sell 10 million shares which will add further downward pressure to the stock. At current prices it is difficult to recommend Twitter stock; I will be keeping an eye on user growth and revenue per user which will be the key drivers going forward.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868241-twitter-tries-to-take-a-bite-out-of-the-advertising-pie?source=feed

Aucun commentaire:

Enregistrer un commentaire