Turkey has been one of the more successful emerging markets over the last few years, and investors have seen the market, as represented by iShares Turkey ETF (TUR) dramatically increase in value since the 2009 financial crisis. This picture reversed rapidly in June, as a public protest over the development of a park escalated to violent rioting, and a sharp sell-off, TUR losing 14% of its value over a couple of trading sessions.

In December, further turmoil emerged, as a scandal broke around the government of the AKP, (Justice and Development Party), which has ruled Turkey since 2002. Allegations of corruption involving Turkish big business, notably in the financial and manufacturing sectors has circled ever closer to Prime Minister Erdogan, whose position now looks under threat. The stock market has sold off further in response, losing the ground gained since the recent bottom in the summer.

In this article I will evaluate Turkey as an investment, and consider whether to use the current pull-back as a buying opportunity for Turkish stocks. As with previous articles on Indonesia, Thailand, and Malaysia, I will start with an overview of the economic and political history of Turkey.

Economic and Political History

Turkey sits astride the gateway between Europe and Asia, and as such has been central to Europe/Asia trade for centuries. Turkey formed part of a series of early empires, including Persian, Roman, and Mongol and was the center of the independent Ottoman empire which peaked in power in the 16th Century, but was still mainly intact as the Turkish Empire at the beginning of World War I. Turkey was defeated, and the allies occupied the region from the capital of Istanbul. A group of Turkish army officers, lead by Mustafa Kemal, formed a dissident government in the city of Ankara. A war of independence ensued, culminating in the formation of the modern Republic of Turkey in 1923, ending six centuries of rule by the Ottoman sultanate. Kemal was the first president of the modern secular Republic.

Kemal instituted a series of political and social reforms, designed to pull Turkey up to parity with its European neighbors. These included the establishment of a legislative General Assembly, elected by proportional representation, and a multi-party democratic system. Islamic law was replaced with a new legal code which was based on Swiss law. Turkey became one of the earlier democracies to pursue women's political equality, according universal suffrage in 1934.

On the economic front, significant and rapid progress was made. Agrarian reform allowed a broader distribution of land rights, and model farms were established to ensure improvements in production efficiency. Kemal presided over a high degree of state economic involvement, which formed state owned enterprises to fast track development in the banking sector, and key industrial enterprises, such as textile manufacturing. Foreign interests in strategic areas such as the railways and tobacco industry, were confiscated and nationalized.

In this period, the development of local capacity to substitute the reliance on imported goods was a major plank of economic reform - Turkey's economic policy became single-minded to the degree of economic isolationism.

Turkey remained neutral through most of WWII, while keeping a meaningful military capability. The financing of this required significant public borrowing. High debt levels, and high levels of imports became a feature of Turkish economics, through the post war decades, resulting in several debt-inflation-balance of payments crises. Inflation was at 25% plus levels several times in this period.

In the 1980's under the leadership of Turgut Ozal, Turkey shifted gears. Ozal's strategy was to focus on the development of an export based economy. This started with ensuring Turkey could compete on a level playing field. Government spending was reduced, which eliminated many of the protectionist economic policies and subsidies. In this decade, Turkey prospered on the back of these reforms. This was helped by the Iran-Iraq war, as Turkey traded actively with both countries, benefiting from its strategic location on the oil routes to Europe. However, unemployment and inflation persisted as key concerns, both running at double digit percentages for most of the 80's.

High levels of government spending generated another economic crisis which emerged in 1994. Government debt rose to 17% of GDP in 1993, and government reacted by raising significant foreign debt, which resulted in overheating the economy, downgrading of Turkey's credit rating, and a 75% devaluation of the Turkish lira. Significant austerity measures were required to comply with the terms of an IMF bail-out package.

The lack of political commitment to this disinflation package resulted into an economy that maintained the structural fragility through the rest of the 90's and was badly impacted by the double hits of the Russian economic crisis and two devastating earthquakes, with yet another currency crisis in 1999.

The current phase of political and economic development has been under the auspices of the AKP, which has been able to maintain a sufficient majority to form a single party liberal democratic government. Turkey has embarked on continued liberalization and social reform, and actively courted the European Union.

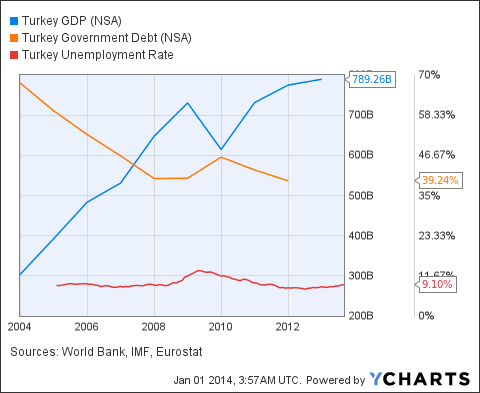

As a result of this, GDP has grown at a rapid rate, unemployment has been controlled in the single digits, and the government has been able to consistently reduce the level of government borrowing, which is now below 40% of GDP. Even the financial crisis of 2008 generated a pause in the rate of development - a testament to the higher level of resilience of the new Turkey.

Turkey GDP data by YCharts

Economy and Outlook

Turkey benefits from two fundamental factors which provide its economic potential. One is a strong demographic profile - with 86.5% of the population under the age of 55, and a median age of 29.3, according to a July 2013 estimate by index mundi. The second is its geographical location - which puts Turkey in an ideal position to link the European and Asian continents.

Realization of this potential requires good stewardship, and until the protests of summer 2013, the stable single party rule of the AKP had convinced the markets that Turkey was in safe hands. The government has set a target for Turkey to be a top ten global economy by 2023, with a per capita income of USD 25,000 and GDP of USD 2 trillion.

Today's Turkish economy is in good shape on most metrics.

Q3 2013 GDP growth was 4.4%, mainly driven by an increase in private consumption, which rose 5.1% in the face of stable government spending (+0.6%). Government estimates are for GDP growth of 3.6% for 2013, and 4% in 2014.

Inflation is in the high single digits, but trending downwards, with CPI estimated by the Central Bank of Turkey to increase 6.8% in 2013, moderating slightly into 2014. The Central Bank target inflation rate is 5%.

Industrial production has increased in 2013 by an annual average of 3.8%, a growth rate expected to increase to 4.5% in 2014.

Turkey is however grappling with a current account deficit of around 7% of GDP - which leaves it vulnerable to currency devaluation.

According to the IMF, Turkey is in a strong position to develop sustained economic growth. In order to do so, it should reduce its vulnerability to external financing by courting foreign investment and increasing domestic savings, which lag behind its EM peer group.

Furthermore, there is room for significant export growth, as shown by the following peer comparison of 2010/2011 exports as a percentage of GDP.

Source - World Bank.

A little help please!

In 2013, the World Bank provided Competitiveness and Savings Development Policy loan to support stimulus of a more competitive private sector and robust domestic savings profile. The USD 800m loan provides support for Turkey to undertake several key structural reforms to the private sector. This includes a new Commercial Code, Credit reforms, stronger corporate and fiscal governance, and critically, a new private pensions program. The World Bank loan compliance process includes systematic monitoring of agreed reforms, and key performance indicators.

This loan underpins the key activities expected to be included in the upcoming 10th 4 year plan, due to run from 2014. A clear and transparent reform program, complemented by independent World Bank supervision significantly increases the odds for Turkey to succeed in its goal of significant growth.

Investing in Turkey

The simplest way to invest in Turkey is via the iShares MSCI Turkey ETF . TUR is a market capitalization weighted fund, which has been available since 2008. Management fees are 0.61%. As at year end 2013, TUR is priced at $47.6 (off a high of $77.4), with a trailing PE of around 10, and yields 2%.

TUR has performed well vs S&P 500 (SPY) for most of the time since its 2008 inception, as shown by the following chart from Y charts. The current dip erodes the significant progress, and brings TUR into what looks like an attractive valuation on a like for like basis, effectively back to the starting valuation in 2008. TUR performance is also favorable compared to the broader iShares EEM.

Alternatively, Turkish Investment Fund (TKF) is a closed end fund managed by Morgan Stanley. TKF has a relatively broad base of investments, and a higher expense ratio of 1.15%, with a distribution yield of 1.48% (data from Closed End Fund Center). Since 2008, TKF has underperformed both TUR and EEM.

The following table shows the relative asset allocations of the two funds, with TUR having a significantly heavier weighting towards financial institutions - skewed as a result of the FI higher market capitalization.

Asset Class | TKF | TUR | |

Financials | 39.0% | 46.2% | |

Consumer Goods | 30.3% | 20.3% | |

Industrials | 11.4% | 13.7% | |

Telecommunications | 10.2% | 8.22% | |

Non Classified Equity | 3.98% | ||

Oil & Gas | 3.85% | 3.75% | |

Materials | 6.88% | ||

Other | 1.22% | 0.92% | |

100% | 100% |

This could be viewed as a relatively high risk allocation, however investors can take some comfort in the experience of 2009, in which the financial crisis impacted TKF more heavily than the more diversified TUR.

See below the 2 funds over the period.

On balance,this analysis shows TUR to be a lower management expense, higher yielding and better investment performance option.

The bottom line.

Turkey is one of the best placed emerging market economies from a geographical and demographic point of view, with close links to Europe making it a natural beneficiary of a European recovery.

History has shown that the Turkish economy has been highly prone to economic crises, which have held back this extremely well placed economy from realizing its full potential. Economic growth has been a consistent feature of periods of stable single party government. The AKP has been such a government.

In partnership with the World Bank - the AKP is embarking on a period of investment in developing Turkey's economic infrastructure - aiming to accelerate Turkey into a top ten economy by 2023.

The current government of Erdogan is undergoing a crisis, which has, combined with a bearish market view on emerging economies, severely impacted the stock market, which now presents attractive valuations.

TUR represents an efficient vehicle for those seeking exposure to Turkey.

Aggressive investors might seek to take a position now - my own strategy would be to await some resolution of the immediate crisis. Assuming the AKP survives the next months, I will be looking to initiate a position for a long term investment. With 2015 elections due, I would consider splitting this between a short term opportunistic play (12 month horizon), pending the election outcome, and a longer term position (5+ years).

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: The author is a private investor, not an investment advisor. Opinions are shared for readers interest and should not be taken as investment advice. Always consult an investment advisor.

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire